Payday Loans for Federal Government Employees?

-

That’s a very good — and nuanced — business question. Structuring and marketing payday-style financial products for federal employees during government shutdowns requires careful balance between financial need, compliance, and public perception. Let’s go step-by-step through both the product design and marketing strategy.

🧱 1. Product Structure

Federal employees affected by shutdowns present a unique risk and repayment profile — typically low default risk but temporary liquidity stress.

You can design products that address that specific pain point, distinguishing them from predatory payday lending.A. Loan Type: Short-term “Bridge” Advance

- Purpose: Cover missed paychecks during a government shutdown.

- Loan size: Typically $500–$3,000, depending on the borrower’s verified federal salary.

- Term: 30–90 days after the government reopens (not a fixed calendar date).

- Repayment: Automatically via ACH or payroll deduction once pay resumes.

B. Interest and Fees

- Position as a low-cost emergency advance, not a high-interest payday loan.

- Consider flat-fee or 0% interest with a small administrative fee — e.g., $25–$50 per loan.

- Alternatively, offer tiered APRs (e.g., 5–15%) depending on borrower’s tenure or credit score.

- Some credit unions offer 0% loans for up to $1,500 repayable over 6 months — that’s your competitive benchmark.

C. Risk Mitigation

- Require federal employment verification (e.g., recent pay stub or agency ID).

- Structure repayment to begin only once back pay resumes, reducing default probability.

- Optionally use group insurance or reserve funds to cover missed repayments if the shutdown persists.

D. Partnership Opportunities

- Partner with federal employee associations, credit unions, or nonprofits for credibility.

- Co-brand with “Federal Employee Relief Fund”–type initiatives.

- Banks or fintechs can use this as part of Community Reinvestment Act (CRA) outreach.

🧭 2. Marketing and Positioning

Government shutdown lending is politically and reputationally sensitive. The goal is to be seen as helpful and ethical, not exploitative.

A. Messaging Framework

Position as:

“A safety net for America’s public servants during uncertain times.”

Avoid terms like “payday loan” — use “emergency bridge loan,” “shutdown relief advance,” or “paycheck bridge.”

B. Channels

- Digital targeting: Paid search and social media ads aimed at federal workers (interests: “federal government,” “civil service,” “public employee unions”).

- Partnerships: Collaborate with federal employee unions (AFGE, NTEU) or advocacy groups for trusted distribution.

- PR campaigns: Focus on social good — e.g., “We stand with those who keep our government running.”

C. Timing

- Launch within 48 hours of shutdown announcement.

- Pre-market as a preparedness solution (e.g., “Sign up now for pre-approved shutdown support”).

D. Trust Signals

- Transparency: Clearly list costs, repayment terms, and eligibility.

- Offer financial literacy resources and budgeting tools — this builds goodwill and reduces regulatory risk.

- Include testimonials from federal employees (if possible).

️ 3. Compliance and Legal Considerations

️ 3. Compliance and Legal ConsiderationsYou must ensure full compliance with:

-

Federal and state lending laws, including:

- Truth in Lending Act (TILA)

- Military Lending Act (if DoD civilians or active duty are borrowers)

- State usury caps and small loan laws

-

Avoid structures that could be construed as predatory or exploitative.

To stay compliant and credible:

- Register appropriately in all lending states.

- Disclose all fees and APR equivalents, even if positioned as a “service fee.”

- Avoid rolling over loans or compounding interest.

4. Differentiation and Expansion

4. Differentiation and ExpansionOnce established, you could expand into:

- Payroll-linked emergency savings programs (deduct small amounts per paycheck post-shutdown).

- Subscription-based access to low-cost advances (like a “safety fund” for federal employees).

- Employer-partnered relief plans where agencies or unions guarantee repayment post-shutdown.

Example Value Proposition

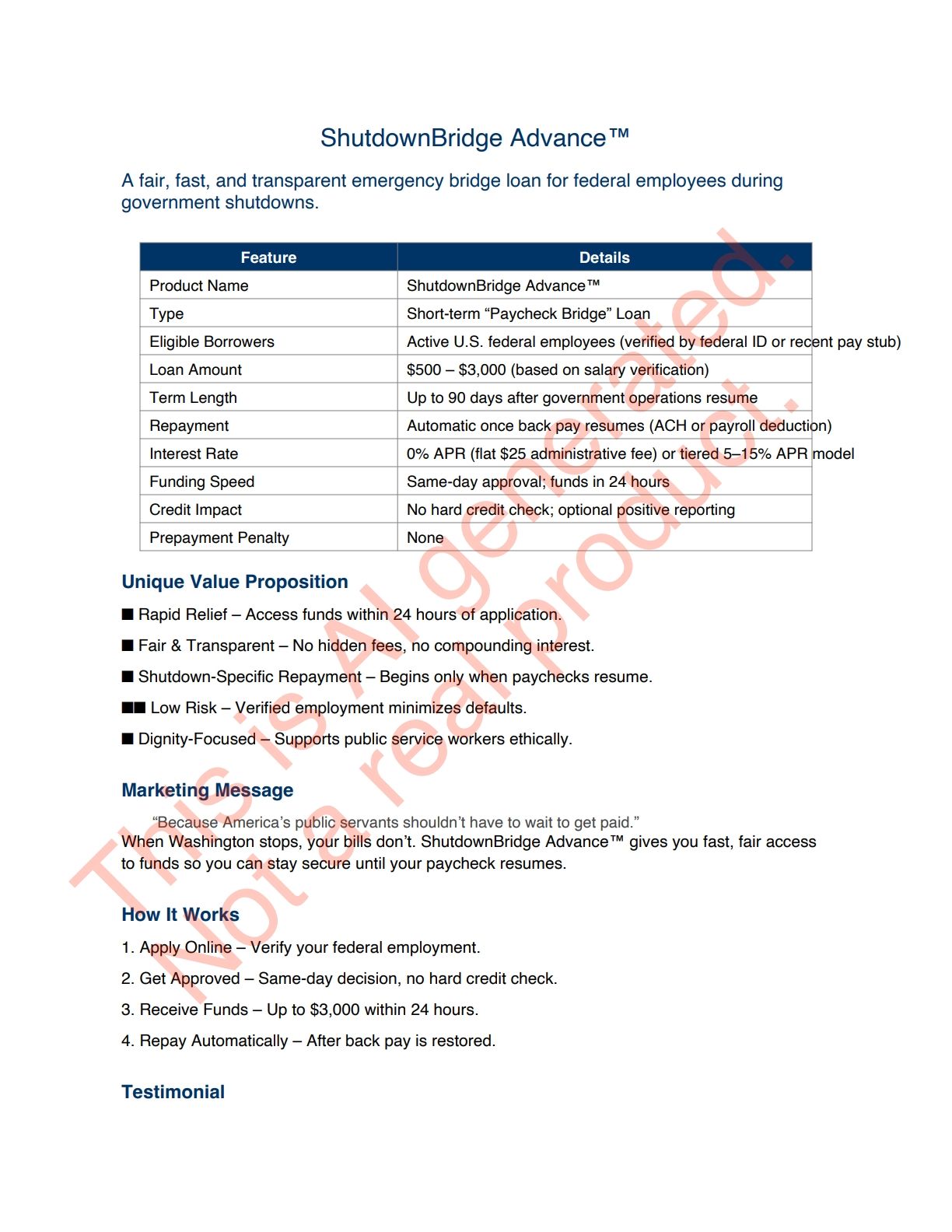

Example Value PropositionShutdownBridge Advance

- 0% interest for up to $2,000

- No payments until your paycheck resumes

- Designed exclusively for active federal employees

- Fast online approval — funds in 24 hours

This combines ethical intent, operational practicality, and solid marketing optics.

Would you like me to draft a sample product sheet and marketing one-pager (with name, features, terms, and compliant marketing copy)? That would show how to present it effectively to investors, regulators, or potential partners.

-

Need some cash, Ax?

-

https://www.csmonitor.com/USA/Military/2025/1010/shutdown-military-pay-gap

At the Army Community Center, where she provides financial counseling, Ms. Pena-Delgado says there’s been “a flood of soldiers” coming in for emergency pay loans. ...

... A quarter of service members have less than $500 in savings, according to advocacy organizations. ...

-

Wow, that’s going to be embarrassing when the military actually gets paid on the 15th.