Trump to Mamdani: Hold my beer

-

@jon-nyc said in Trump to Mamdani: Hold my beer:

Of course. If your party thinks of it, it is great.

If the exact same idea is proposed by the other side, it is a terrible idea. LOL

-

@jon-nyc said in Trump to Mamdani: Hold my beer:

Of course. If your party thinks of it, it is great.

If the exact same idea is proposed by the other side, it is a terrible idea. LOL

@taiwan_girl said in Trump to Mamdani: Hold my beer:

@jon-nyc said in Trump to Mamdani: Hold my beer:

Of course. If your party thinks of it, it is great.

If the exact same idea is proposed by the other side, it is a terrible idea. LOL

Not at all. We think it’s horrible. We just think it’s better than the alternative that we had.

-

If your options are to watch your home being flooded or have your house and every item in it burn to the ground, with you and your family in it, you take the flood. It doesn’t make you happy for the flood…

-

@jon-nyc said in Trump to Mamdani: Hold my beer:

Of course. If your party thinks of it, it is great.

If the exact same idea is proposed by the other side, it is a terrible idea. LOL

@taiwan_girl said in Trump to Mamdani: Hold my beer:

@jon-nyc said in Trump to Mamdani: Hold my beer:

Of course. If your party thinks of it, it is great.

If the exact same idea is proposed by the other side, it is a terrible idea. LOL

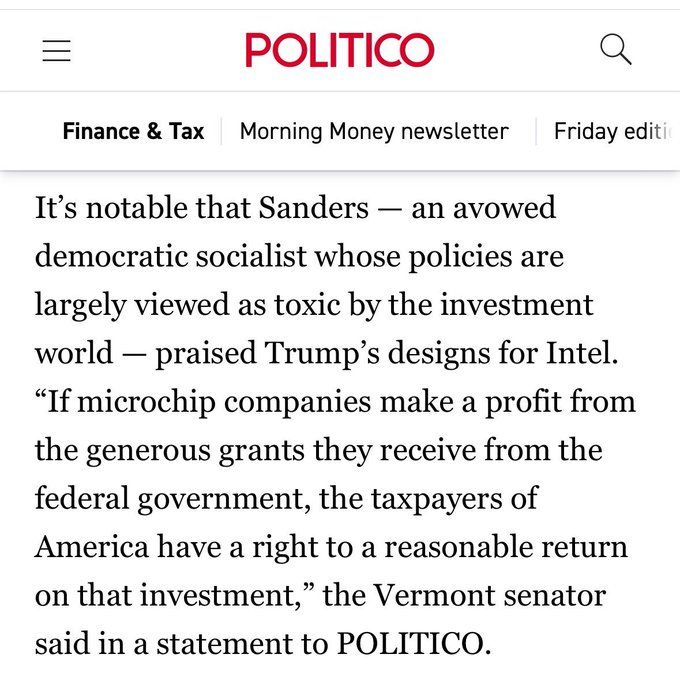

Give Bernie credit. He liked state run capitalist experiments when Obama did them and he likes them when Trump does them.

-

https://www.washingtonpost.com/opinions/2025/08/24/trump-intel-government-marketplace/

Op-ed discusses risks of Intel, in the future, making decisions more with politics in mind rather than economics.

The most immediate risk is that Intel’s decisions will increasingly be driven by political rather than commercial considerations. With the U.S. government as its largest shareholder, Intel will face constant pressure to align corporate decisions with the goals of whatever political party is in power. Will Intel locate or continue facilities — such as its long-delayed “megafab” in Ohio — based on economic efficiency or government priorities? Will it hire and fire based on merit or political connections? Will research and development priorities reflect market demands or bureaucratic preferences? Will standard corporate finance decisions that are routinely (and mistakenly) pilloried in Washington, such as dividends or stock buybacks, suddenly become taboo?

...

The deal’s terms, ... : [The government] purchased shares at $20.47 instead of Friday’s $24.80 closing price — a discount at current shareholders’ expense. Intel’s board green-lit the below-market transaction without shareholder approval, showing how management now prioritizes government interests over fiduciary duties. And the deal allows the government to purchase an additional 5 percent of the company at $20 per share if Intel sells part of its struggling foundry business, thus distorting government and management views of specific corporate restructuring decisions.