On paying off your house

-

@blondie said in On paying off your house:

You were very smart @Renauda . And you timed it right.

My spouse timed it right. I was very sceptical about the purchase and probably would not have pursued it. She, on the other hand, had been doing her homework and came to the rightful conclusion it was either pull the trigger then or forget it as land prices in the valley were about to soar. She was, of course, right.

Besides, I had already vetoed one property deal just above the road into Naramata three months earlier because there was a 10’ wide surface right of way for a buried and active gas distribution line right through the middle of the .75 acre lot. I therefore decided that being too much of a stick in the mud was not advisable as there were zero defensible technical reasons to say no again.

-

We paid off the house and never looked back. My wife isn't a big fan of owing anyone anything even at low interest rates (nothing wrong with a low interest mortgage--actually it's a better use of the money, we're just queasy about not owning.) Anyway, never looked back.

-

We left a relatively small amount on ours, as otherwise we'd have needed to borrow for home upgrades at a higher interest rate. I'm currently only paying a couple of hundred a month on the mortgage, and will probably pay it off when I retire with a lump sum from my very modest UK company pension.

TBH, I'd have preferred to pay it off completely, but the Mrs. talked me out of it.

@Doctor-Phibes said in On paying off your house:

We left a relatively small amount on ours, as otherwise we'd have needed to borrow for home upgrades at a higher interest rate. I'm currently only paying a couple of hundred a month on the mortgage, and will probably pay it off when I retire with a lump sum from my very modest UK company pension.

TBH, I'd have preferred to pay it off completely, but the Mrs. talked me out of it.

I have a money-savvy friend who also did this. He'd arranged an off-set account containing the money still owing in full, so his monthly payments were tiny.

-

My case makes no good financial sense to pay it off. I would save approx. $900 a month with a paid off home but I would have to draw most of the funds from my 401K to do so. I owe $155,000 at a 4.5% rate and am on my 4th year of an ARM that will do it's next interest rate change in July 2028. My financial advisor highly recommends to not pay it off. I'm paying about $7000 in interest every year. As retirement nears, I have already moved a quarter million of my 401K to an annuity with Athene. We looked at my future bills, lifestyle, and he thought that this would be a nice extra stream of income added to my other annuities of pension and SS. I have to wait 1 year before it starts doling out $1600 a month, $1200 after tax. I've calculated its course giving an average of 4% return annually after considering the 1% annual fee. I am capped to not make anything over 6% in any given year but I also lose zero dollars if the markets have a bad year. That's a piece of mind I can get behind. Anyways, it would run down to 0 in about 20 years, but they still pay me until I die if I last longer than 20. Anything left in the account upon my untimely death goes to my heir. And I can bolt from the whole thing in 10 years. I like the built in restraint from me wanting to buy big things that I don't necessarily need. I have been the grasshopper most of my life and have taken more loans out on my 401k that I care to count. If I were an ant, that pot should be 2 to 3 times bigger than it is now after 40 years of pitching into it, with the govt. matching first 5%. But grasshoppers are gonna hop. Home improvements mostly with a little fun. It's ok though cuz Uncle Sam has this nice thing waiting for me called a pension. Ever heard of it?

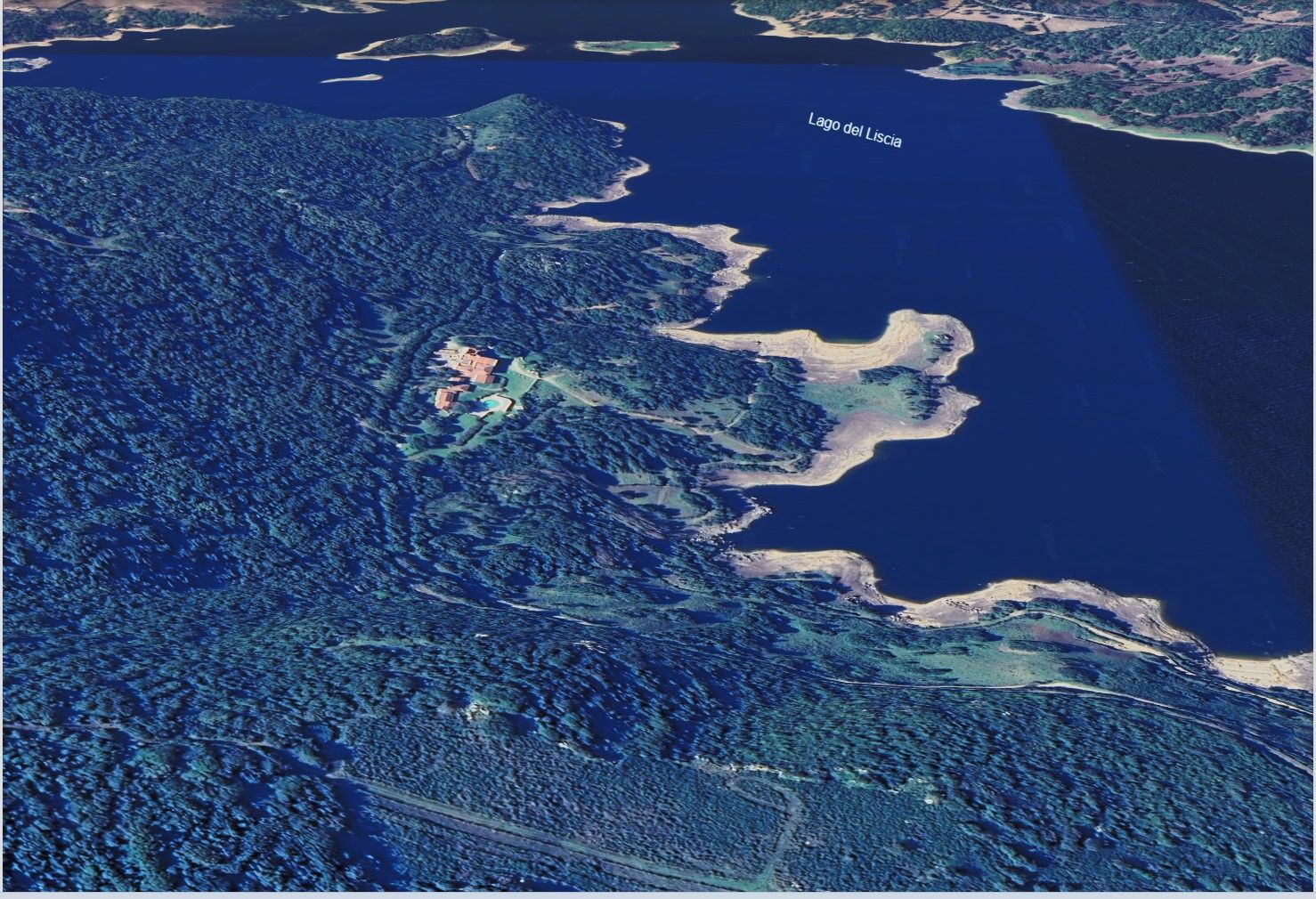

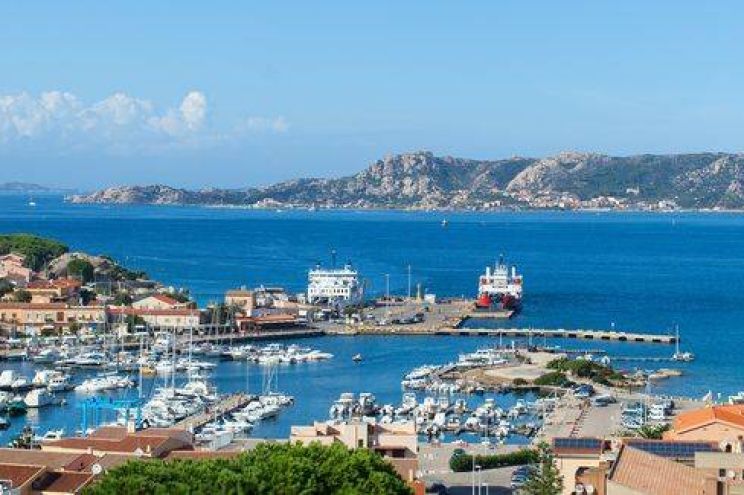

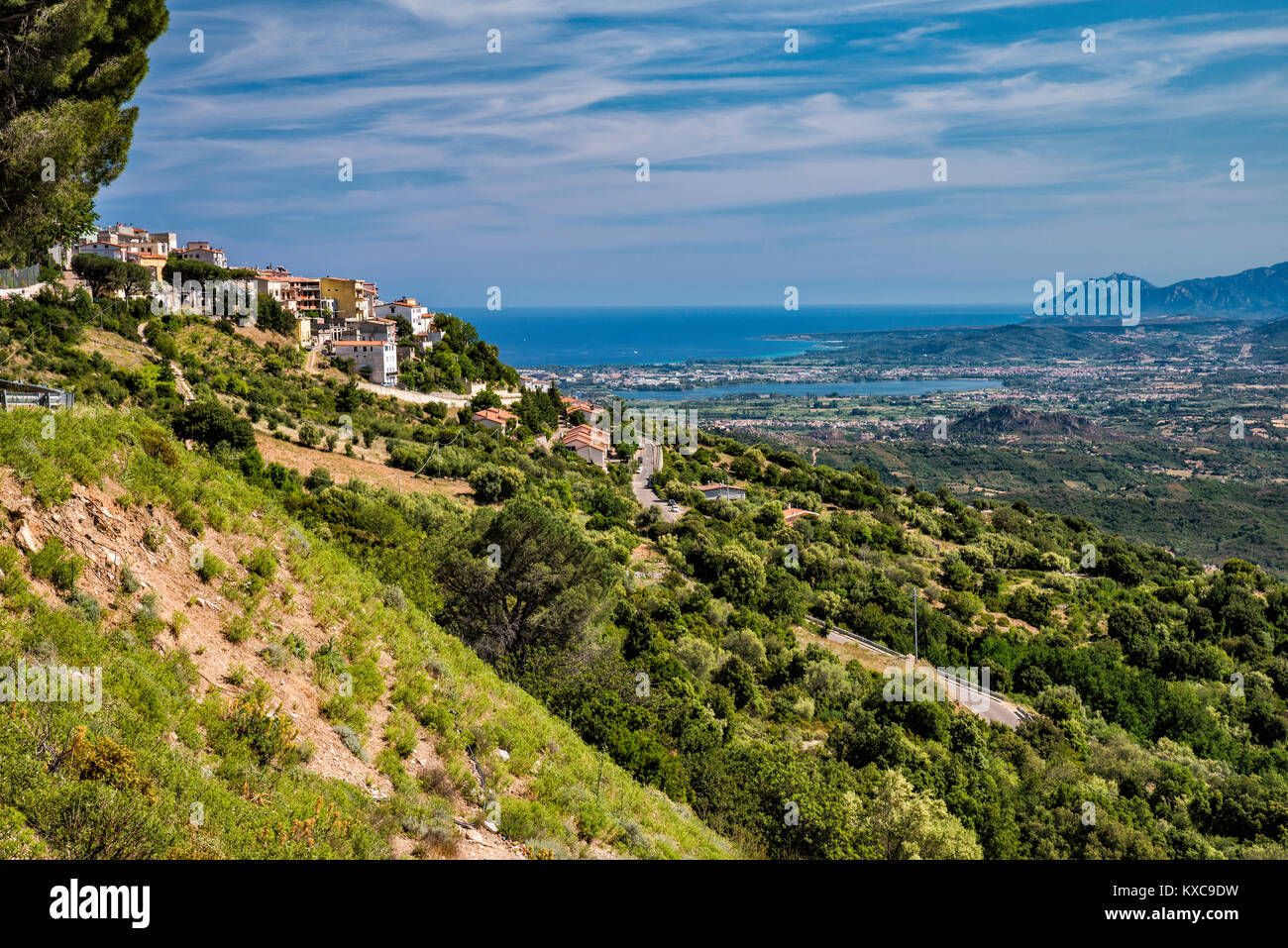

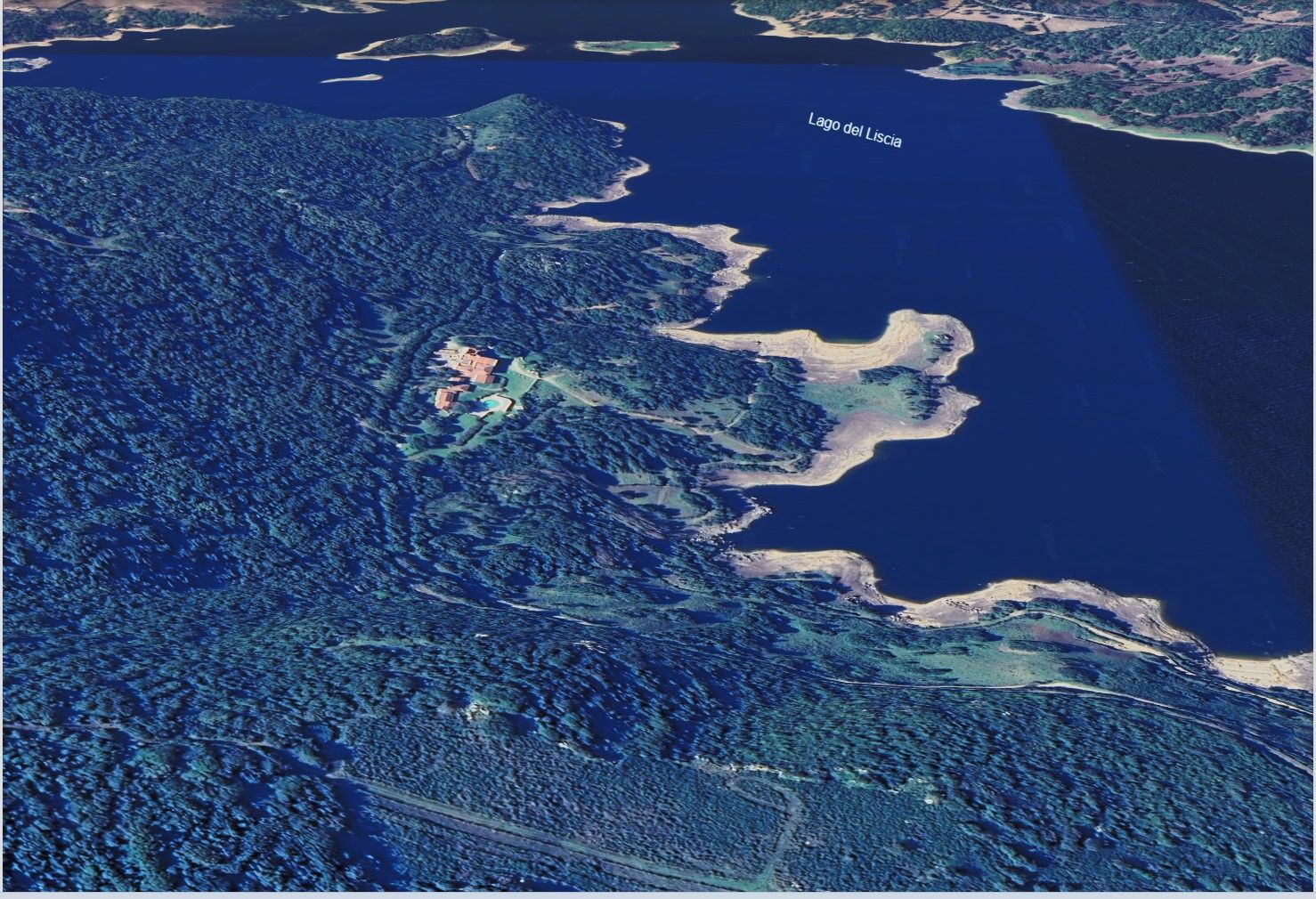

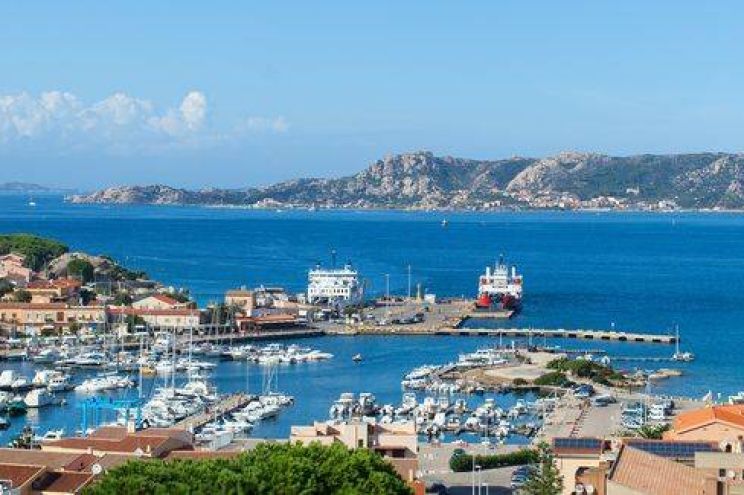

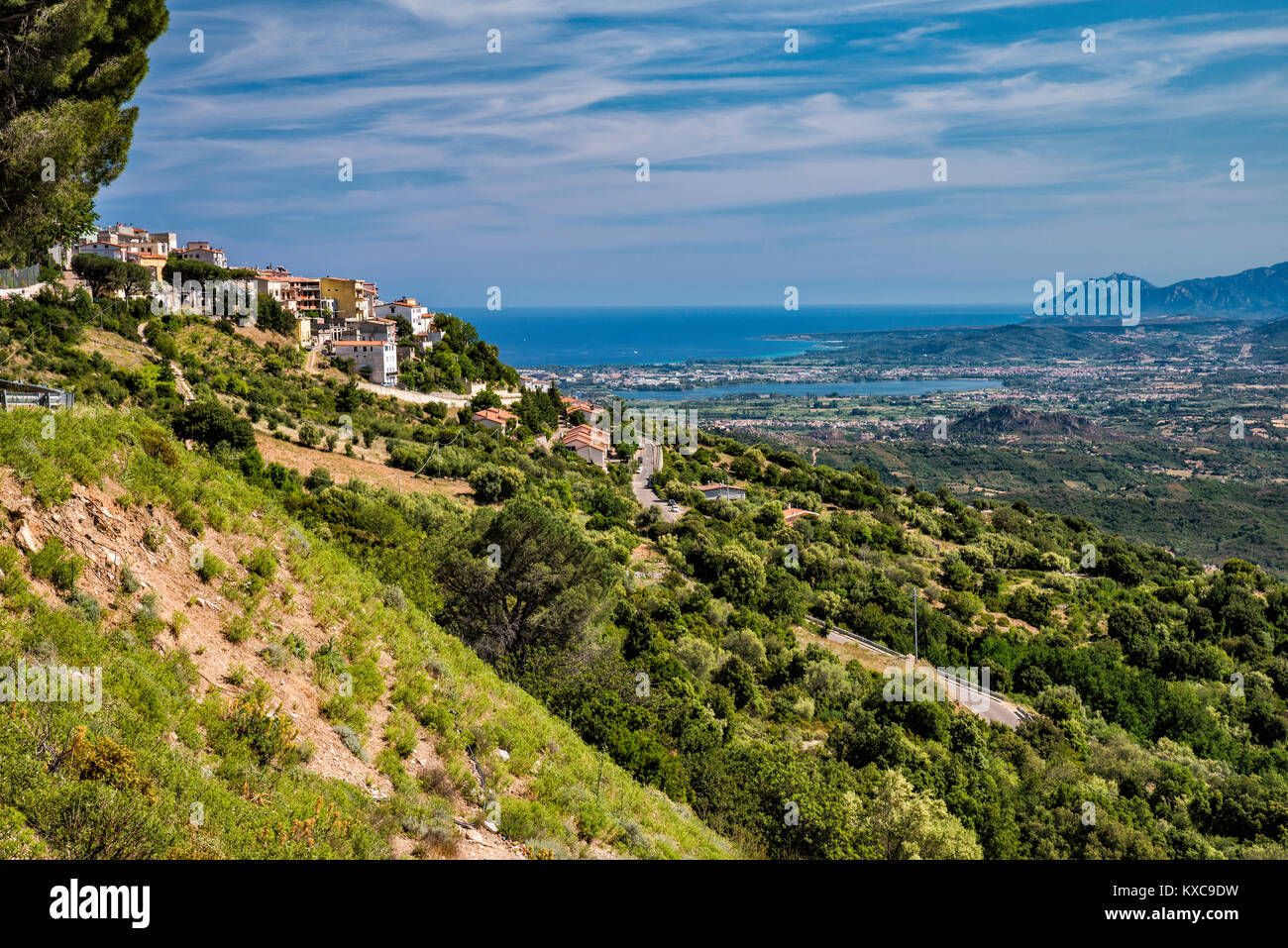

The bigger chunk of my 401K will move to a buffered ETF that I will let my financial guy manage for 3/4% a year and will choose between various protection levels as we see the markets run. We have held off on doing this now as there's a crazy man pulling levers and pushing buttons like a little boy and I have it parked in the safe zone of my govt 401K called the TSP. Thrift Saviings Plan. There are 5 core funds that one can put their money into and I prudently moved it all to the safe G fund (Treasury Securities) back in November as I am getting close to retire and I heard what Buffet had just done moving so much to cash. So come January we will find the right ETF for me and with hope, I will just watch it grow and won't have to touch it for a long while.But there is that piano and cabin cruiser that this grasshopper must have so there is that. Renting my home out here in Californina will give me another monthly stream too. I'll give it a couple of years to decide if Sardinia is forever, and if so, will sell the home and buy my Italian villa on a hill overlooking the Med with cash. I don't mind sharing my personal finances with folks, I actually would like to hear others' input and suggestions for a better way if there is one. Trip to Sardinia is paid for now and I go for a 2 week vacay recon on my 62nd birthday in 2 weeks. Boy, are you guys going to get a boatload of pictures,. I have lodgings setup at about 10 different locations, here are some pics of them.

The bigger chunk of my 401K will move to a buffered ETF that I will let my financial guy manage for 3/4% a year and will choose between various protection levels as we see the markets run. We have held off on doing this now as there's a crazy man pulling levers and pushing buttons like a little boy and I have it parked in the safe zone of my govt 401K called the TSP. Thrift Saviings Plan. There are 5 core funds that one can put their money into and I prudently moved it all to the safe G fund (Treasury Securities) back in November as I am getting close to retire and I heard what Buffet had just done moving so much to cash. So come January we will find the right ETF for me and with hope, I will just watch it grow and won't have to touch it for a long while.But there is that piano and cabin cruiser that this grasshopper must have so there is that. Renting my home out here in Californina will give me another monthly stream too. I'll give it a couple of years to decide if Sardinia is forever, and if so, will sell the home and buy my Italian villa on a hill overlooking the Med with cash. I don't mind sharing my personal finances with folks, I actually would like to hear others' input and suggestions for a better way if there is one. Trip to Sardinia is paid for now and I go for a 2 week vacay recon on my 62nd birthday in 2 weeks. Boy, are you guys going to get a boatload of pictures,. I have lodgings setup at about 10 different locations, here are some pics of them.

-

My case makes no good financial sense to pay it off. I would save approx. $900 a month with a paid off home but I would have to draw most of the funds from my 401K to do so. I owe $155,000 at a 4.5% rate and am on my 4th year of an ARM that will do it's next interest rate change in July 2028. My financial advisor highly recommends to not pay it off. I'm paying about $7000 in interest every year. As retirement nears, I have already moved a quarter million of my 401K to an annuity with Athene. We looked at my future bills, lifestyle, and he thought that this would be a nice extra stream of income added to my other annuities of pension and SS. I have to wait 1 year before it starts doling out $1600 a month, $1200 after tax. I've calculated its course giving an average of 4% return annually after considering the 1% annual fee. I am capped to not make anything over 6% in any given year but I also lose zero dollars if the markets have a bad year. That's a piece of mind I can get behind. Anyways, it would run down to 0 in about 20 years, but they still pay me until I die if I last longer than 20. Anything left in the account upon my untimely death goes to my heir. And I can bolt from the whole thing in 10 years. I like the built in restraint from me wanting to buy big things that I don't necessarily need. I have been the grasshopper most of my life and have taken more loans out on my 401k that I care to count. If I were an ant, that pot should be 2 to 3 times bigger than it is now after 40 years of pitching into it, with the govt. matching first 5%. But grasshoppers are gonna hop. Home improvements mostly with a little fun. It's ok though cuz Uncle Sam has this nice thing waiting for me called a pension. Ever heard of it?

The bigger chunk of my 401K will move to a buffered ETF that I will let my financial guy manage for 3/4% a year and will choose between various protection levels as we see the markets run. We have held off on doing this now as there's a crazy man pulling levers and pushing buttons like a little boy and I have it parked in the safe zone of my govt 401K called the TSP. Thrift Saviings Plan. There are 5 core funds that one can put their money into and I prudently moved it all to the safe G fund (Treasury Securities) back in November as I am getting close to retire and I heard what Buffet had just done moving so much to cash. So come January we will find the right ETF for me and with hope, I will just watch it grow and won't have to touch it for a long while.But there is that piano and cabin cruiser that this grasshopper must have so there is that. Renting my home out here in Californina will give me another monthly stream too. I'll give it a couple of years to decide if Sardinia is forever, and if so, will sell the home and buy my Italian villa on a hill overlooking the Med with cash. I don't mind sharing my personal finances with folks, I actually would like to hear others' input and suggestions for a better way if there is one. Trip to Sardinia is paid for now and I go for a 2 week vacay recon on my 62nd birthday in 2 weeks. Boy, are you guys going to get a boatload of pictures,. I have lodgings setup at about 10 different locations, here are some pics of them.

The bigger chunk of my 401K will move to a buffered ETF that I will let my financial guy manage for 3/4% a year and will choose between various protection levels as we see the markets run. We have held off on doing this now as there's a crazy man pulling levers and pushing buttons like a little boy and I have it parked in the safe zone of my govt 401K called the TSP. Thrift Saviings Plan. There are 5 core funds that one can put their money into and I prudently moved it all to the safe G fund (Treasury Securities) back in November as I am getting close to retire and I heard what Buffet had just done moving so much to cash. So come January we will find the right ETF for me and with hope, I will just watch it grow and won't have to touch it for a long while.But there is that piano and cabin cruiser that this grasshopper must have so there is that. Renting my home out here in Californina will give me another monthly stream too. I'll give it a couple of years to decide if Sardinia is forever, and if so, will sell the home and buy my Italian villa on a hill overlooking the Med with cash. I don't mind sharing my personal finances with folks, I actually would like to hear others' input and suggestions for a better way if there is one. Trip to Sardinia is paid for now and I go for a 2 week vacay recon on my 62nd birthday in 2 weeks. Boy, are you guys going to get a boatload of pictures,. I have lodgings setup at about 10 different locations, here are some pics of them.

@NobodySock said in On paying off your house:

OK, who's going to kill him?

I have a school friend from Preston, UK who retired in his 50's to the Island of Rhodes after years of saying he was going to do it. He appears to be blissfully happy.

Meanwhile, I get to retire to Rhode Island. Similar, but different, I think it's fair to say.

-

If I had loadsamoney, I'd buy property in certain areas of London.

Friends paid an eye-watering £800,000 for a one bed flat (37th floor of a docklands building) which rented out day after completion. Rent covers mortgage and gives a small income, and importantly the value of the flat increases.

Some central London properties increase by millions over a decade.

I guess NY, Washington and San Fransisco properties are like this?Our daughter's flat in London increased in value by over 10% during the 6 months it took to complete purchase.

Paid £270k, and as we moved her furniture in we met the estate agent who'd sold our house. Invited in, his valuation was "at least £300k, I'd hope to get 320". -

I bought my first house when I was 24 - had saved up enough money in college for a 20% down payment. A divorce in my 40s erased the equity of that investment. My goal for the next home was to have it paid off by 50 and be prepared to retire by 60. There might have been better investment strategies, but the security of it - was worth something.

-

@NobodySock .. I won’t even start, but there’s no amount of cannabis that could kill the pain of envy I have for you now. I’ll have to wait for death and hope for Heaven.