Another audience, another tax carve out

-

Why not? The Dems have been promising gimmes forever. At least that benefits domestic manufacturing.

@Mik said in Another audience, another tax carve out:

Why not? The Dems have been promising gimmes forever. At least that benefits domestic manufacturing.

No, it punishes foreign. On a larger scale, this is like giving grade bumps to disadvantaged students. This doesn’t promote excellence but instead promotes mediocrity.

-

Not entirely. The proposal revolves around where the vehicle is manufactured. If a foreign company wants to pursue the American market, build your vehicles in America.

Give you an example...Hyundai and LG are dropping over $7B in Georgia to build a battery plant and a vehicle assembly plant: https://www.msn.com/en-us/money/companies/hyundai-begins-producing-electric-suvs-at-its-76-billion-plant-in-georgia/ar-AA1rRq6I?ocid=BingNewsSerp

Between the two, they're talking 8500 jobs at max capacity. And don't forget the construction jobs.

Now, Trump may be just be engaged in campaign spitballing and it may be DOA in congress, but it is innovative.

-

@jon-nyc said in Another audience, another tax carve out:

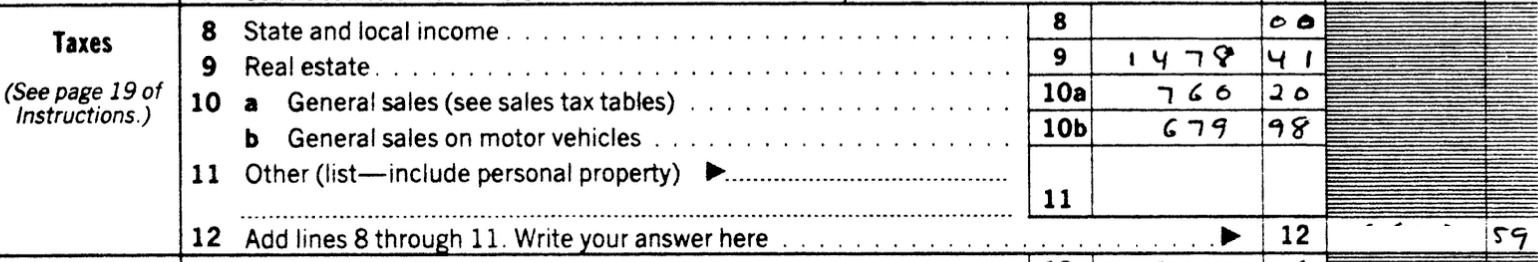

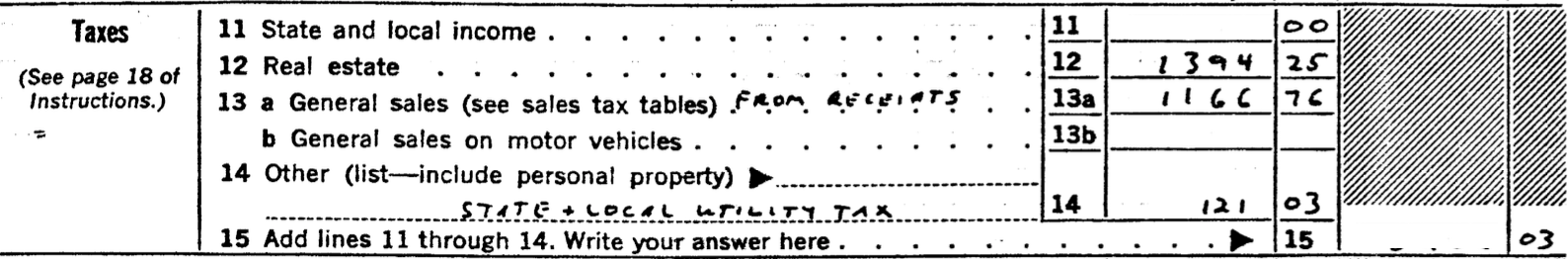

It’s old and new. Remember when all interest was tax deducible?

Remember when sales tax, or any other tax, was deductible?

Losing deductions was supposed to be the tradeoff for lower rates.

-

I didn’t pay income taxes back then but I remember my friends mother kept any and all receipts. She’d have hundreds at the end of the year for her accountant to tally up.

-

Wait, is she not so subtly saying “we’re going to set you up as legal dope dealers”?

-

Uh, no.

-

I don’t know why he doesn’t just promise to remove tax for anyone who votes for him

-

I only just discovered that Social Security wasn’t taxed until the 80’s and Sleepy Joe was one of the Senators that put the bill together.

-

I only just discovered that Social Security wasn’t taxed until the 80’s and Sleepy Joe was one of the Senators that put the bill together.

@LuFins-Dad said in Another audience, another tax carve out:

I only just discovered that Social Security wasn’t taxed until the 80’s and Sleepy Joe was one of the Senators that put the bill together.

Do tell.

Was it part of the bill that contained the WEP and GPO provisions?

-

@LuFins-Dad said in Another audience, another tax carve out:

I only just discovered that Social Security wasn’t taxed until the 80’s and Sleepy Joe was one of the Senators that put the bill together.

Do tell.

Was it part of the bill that contained the WEP and GPO provisions?

@Jolly said in Another audience, another tax carve out:

@LuFins-Dad said in Another audience, another tax carve out:

I only just discovered that Social Security wasn’t taxed until the 80’s and Sleepy Joe was one of the Senators that put the bill together.

Do tell.

During Ronald Reagan’s presidency, major reforms to the Social Security system were enacted, primarily through the Social Security Amendments of 1983. These reforms were designed to address a looming financial crisis in the Social Security program, which was at risk of running out of funds by the mid-1980s. The changes made under Reagan were a result of bipartisan cooperation, notably through the Greenspan Commission, a group formed to study the financial health of the Social Security system.

Here are the key elements of the Social Security reforms under Reagan:

- Increase in Payroll Taxes

One of the central reforms was a gradual increase in the payroll tax rate. The payroll tax, which funds Social Security, was raised for both employers and employees. By the end of the 1980s, the payroll tax rate had increased from 6.7% to 7.65% for both employers and employees (a combined rate of 15.3%).

- Gradual Increase in the Full Retirement Age

The 1983 reforms also raised the full retirement age at which beneficiaries could receive full Social Security benefits. Prior to the reforms, the full retirement age was 65. The reforms initiated a gradual increase, eventually raising the full retirement age to 67 for people born in 1960 or later. This change was intended to reflect the increasing life expectancy of Americans and reduce the long-term financial burden on the system.

- Taxation of Social Security Benefits

For the first time, a portion of Social Security benefits became subject to federal income tax. Under the 1983 reforms:

• If a retiree’s combined income (including Social Security benefits, wages, and other sources) exceeded a certain threshold, up to 50% of their Social Security benefits could be taxed.

• This taxation applied to individuals with income over $25,000 and couples with income over $32,000. Later, in 1993, this taxation level was increased, allowing up to 85% of Social Security benefits to be taxed for higher-income recipients.- Inclusion of Federal Employees

Prior to the 1983 reforms, many federal employees were not part of the Social Security system, as they had their own separate pension programs. The reforms mandated that new federal employees, hired after 1983, would be required to participate in Social Security, expanding the pool of contributors.