Groceries are high everywhere...

-

@taiwan_girl said in Groceries are high everywhere...:

President Biden clearly controls everything in the world and the inflation in grocery prices in other countries is obviously his fault.

No,?but he is the one to fan the flames by telling voters that the high prices are because of greedy corporations…

@LuFins-Dad said in Groceries are high everywhere...:

@taiwan_girl said in Groceries are high everywhere...:

President Biden clearly controls everything in the world and the inflation in grocery prices in other countries is obviously his fault.

No,?but he is the one to fan the flames by telling voters that the high prices are because of greedy corporations…

I agree, but just part of the "it is everybody fault but me" when things go wrong thinking that US presidents have.

(Actually, it is probably all politicians worldwide, not just US presidents)

-

@LuFins-Dad said in Groceries are high everywhere...:

@taiwan_girl said in Groceries are high everywhere...:

President Biden clearly controls everything in the world and the inflation in grocery prices in other countries is obviously his fault.

No,?but he is the one to fan the flames by telling voters that the high prices are because of greedy corporations…

I agree, but just part of the "it is everybody fault but me" when things go wrong thinking that US presidents have.

(Actually, it is probably all politicians worldwide, not just US presidents)

(Actually, it is probably all politicians worldwide, not just US presidents)

Beyond any doubt.

-

There’s only one solution. A $50 minimum wage.

@LuFins-Dad said in Groceries are high everywhere...:

There’s only one solution. A $50 minimum wage.

According to Tucker Carlson a better solution would be a $200 weekly wage.

-

@LuFins-Dad said in Groceries are high everywhere...:

There’s only one solution. A $50 minimum wage.

According to Tucker Carlson a better solution would be a $200 weekly wage.

@Doctor-Phibes said in Groceries are high everywhere...:

@LuFins-Dad said in Groceries are high everywhere...:

There’s only one solution. A $50 minimum wage.

According to Tucker Carlson a better solution would be a $200 weekly wage.

Unless you are contract soldier on a Special Military Operation in Novayarossia. There you theoretically can earn the ruble equivalent of $2200 per month. Chances of ever seeing that money though are, at best, highly speculative and subject to unimaginably harsh conditions.

-

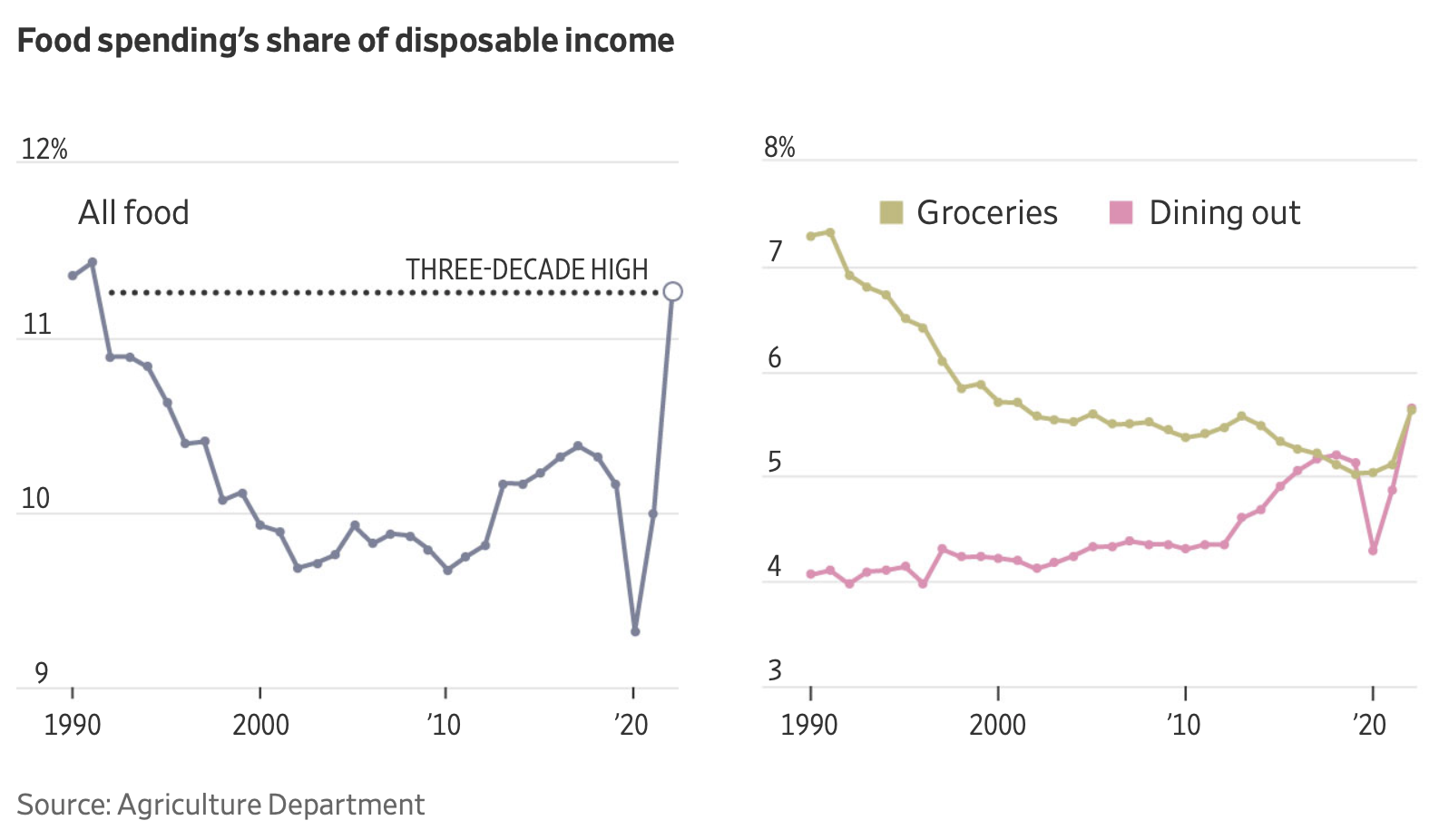

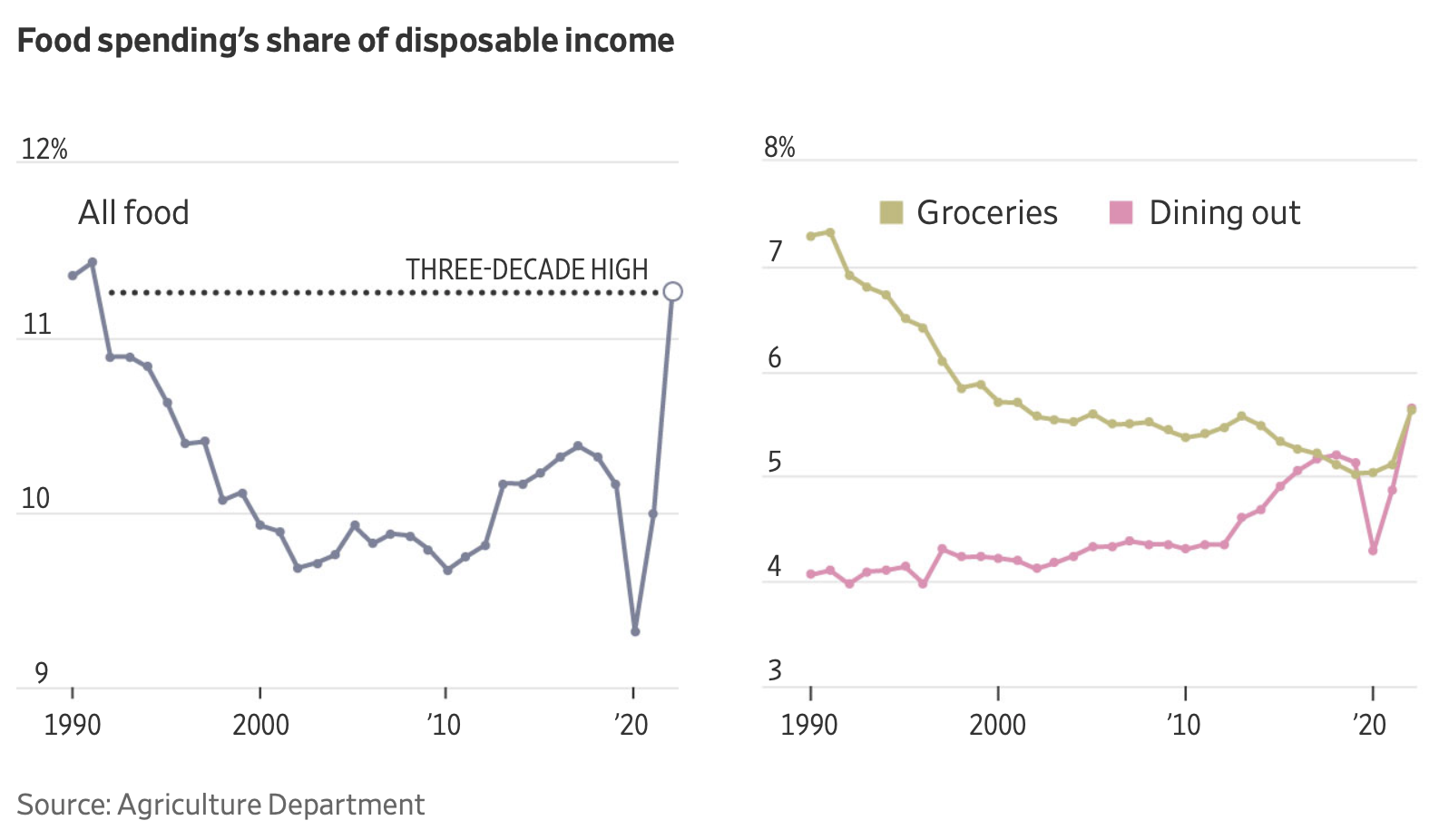

WSJ: It’s Been 30 Years Since Food Ate Up This Much of Your Income

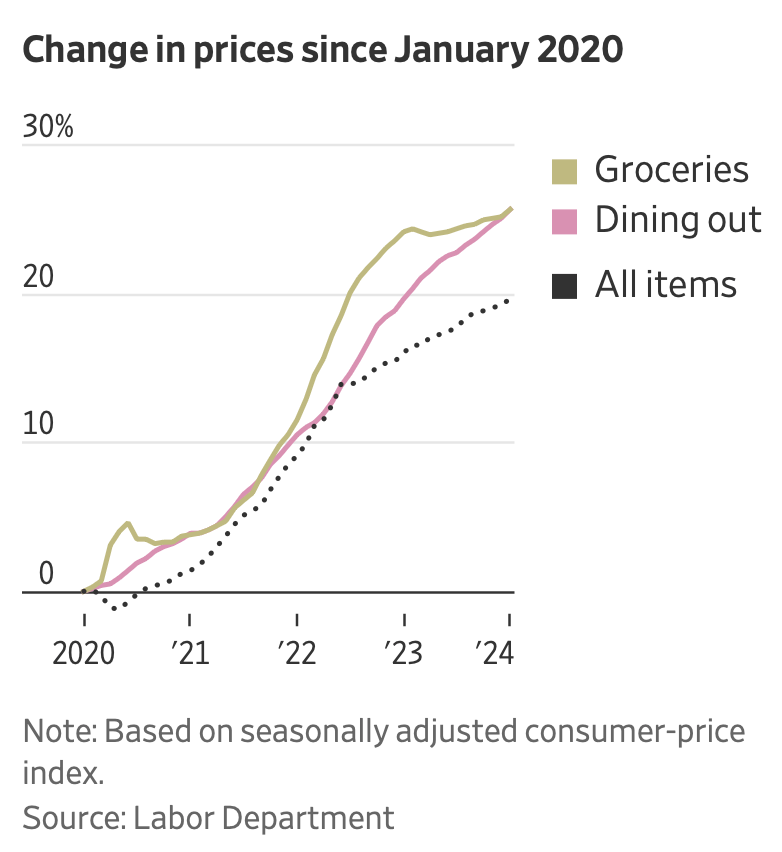

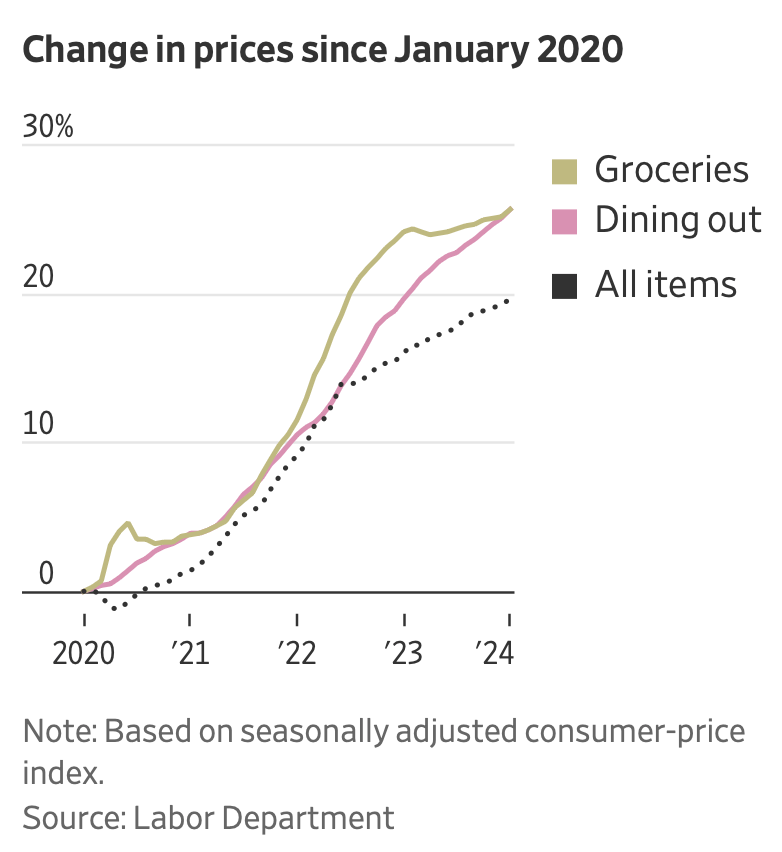

Eating continues to cost more, even as overall inflation has eased from the blistering pace consumers endured throughout much of 2022 and 2023. Prices at restaurants and other eateries were up 5.1% last month compared with January 2023, while grocery costs increased 1.2% during the same period, Labor Department data show.

Relief isn’t likely to arrive soon. Restaurant and food company executives said they are still grappling with rising labor costs and some ingredients, like cocoa, that are only getting more expensive. Consumers, they said, will find ways to cope.

“If you look historically after periods of inflation, there’s really no period you could point to where [food] prices go back down,” said Steve Cahillane, chief executive of snack giant Kellanova, in an interview. “They tend to be sticky.”

In 1991, U.S. consumers spent 11.4% of their disposable personal income on food, according to data from the U.S. Department of Agriculture. At the time, households were still dealing with steep food-price increases following an inflationary period during the 1970s.

More than three decades later, food spending has reattained that level, USDA data shows. In 2022, consumers spent 11.3% of their disposable income on food, according to the most recent USDA data available.

Food inflation has raised the ire of President Biden, who took to Instagram during the Super Bowl to blast food makers that he said were providing less bang for consumers’ buck—putting fewer chips in each bag or shrinking the size of ice cream containers.

-

You can still keep grocery bills low if you're a careful shopper. Not so much with restaurants. I'm seeing a lot more $30+ dishes that were $19 in 2020.

@Mik said in Groceries are high everywhere...:

You can still keep grocery bills low if you're a careful shopper. Not so much with restaurants. I'm seeing a lot more $30+ dishes that were $19 in 2020.

True.

But you have to shop really hard in the grocery store.

-

WSJ: It’s Been 30 Years Since Food Ate Up This Much of Your Income

Eating continues to cost more, even as overall inflation has eased from the blistering pace consumers endured throughout much of 2022 and 2023. Prices at restaurants and other eateries were up 5.1% last month compared with January 2023, while grocery costs increased 1.2% during the same period, Labor Department data show.

Relief isn’t likely to arrive soon. Restaurant and food company executives said they are still grappling with rising labor costs and some ingredients, like cocoa, that are only getting more expensive. Consumers, they said, will find ways to cope.

“If you look historically after periods of inflation, there’s really no period you could point to where [food] prices go back down,” said Steve Cahillane, chief executive of snack giant Kellanova, in an interview. “They tend to be sticky.”

In 1991, U.S. consumers spent 11.4% of their disposable personal income on food, according to data from the U.S. Department of Agriculture. At the time, households were still dealing with steep food-price increases following an inflationary period during the 1970s.

More than three decades later, food spending has reattained that level, USDA data shows. In 2022, consumers spent 11.3% of their disposable income on food, according to the most recent USDA data available.

Food inflation has raised the ire of President Biden, who took to Instagram during the Super Bowl to blast food makers that he said were providing less bang for consumers’ buck—putting fewer chips in each bag or shrinking the size of ice cream containers.

@George-K said in Groceries are high everywhere...:

WSJ: It’s Been 30 Years Since Food Ate Up This Much of Your Income

Eating continues to cost more, even as overall inflation has eased from the blistering pace consumers endured throughout much of 2022 and 2023. Prices at restaurants and other eateries were up 5.1% last month compared with January 2023, while grocery costs increased 1.2% during the same period, Labor Department data show.

Relief isn’t likely to arrive soon. Restaurant and food company executives said they are still grappling with rising labor costs and some ingredients, like cocoa, that are only getting more expensive. Consumers, they said, will find ways to cope.

“If you look historically after periods of inflation, there’s really no period you could point to where [food] prices go back down,” said Steve Cahillane, chief executive of snack giant Kellanova, in an interview. “They tend to be sticky.”

In 1991, U.S. consumers spent 11.4% of their disposable personal income on food, according to data from the U.S. Department of Agriculture. At the time, households were still dealing with steep food-price increases following an inflationary period during the 1970s.

More than three decades later, food spending has reattained that level, USDA data shows. In 2022, consumers spent 11.3% of their disposable income on food, according to the most recent USDA data available.

Food inflation has raised the ire of President Biden, who took to Instagram during the Super Bowl to blast food makers that he said were providing less bang for consumers’ buck—putting fewer chips in each bag or shrinking the size of ice cream containers.

Put that in context with rent being up 28% since 2020 https://www.statista.com/statistics/1063502/average-monthly-apartment-rent-usa/, vehicle maintenance being up by 30%, mortgage rates at 7% for much of the country https://www.usbank.com/home-loans/mortgage/mortgage-rates/virginia.html, insurance skyrocketing (both health and property), and groceries are still taking up a larger percentage of income? Wow. People must be putting groceries on their credit cards at 28% interest https://www.forbes.com/advisor/credit-cards/average-credit-card-interest-rate/

But hey! It’s all good! President Uncle Joe has already saved us! And if that doesn’t work, Lame Donald will just put gold lamè over everything. That will make it all better.

-

I just realized I was wrong! It’s not Lame Donald

It’s Lamè Donald!