Zero Hedge - fudging the numbers

-

Not exactly sure what that means. US Stock market didn't seem to mind.

From what is (I think) a relatively unbiased source:

https://www.axios.com/2023/08/29/jolts-july-data

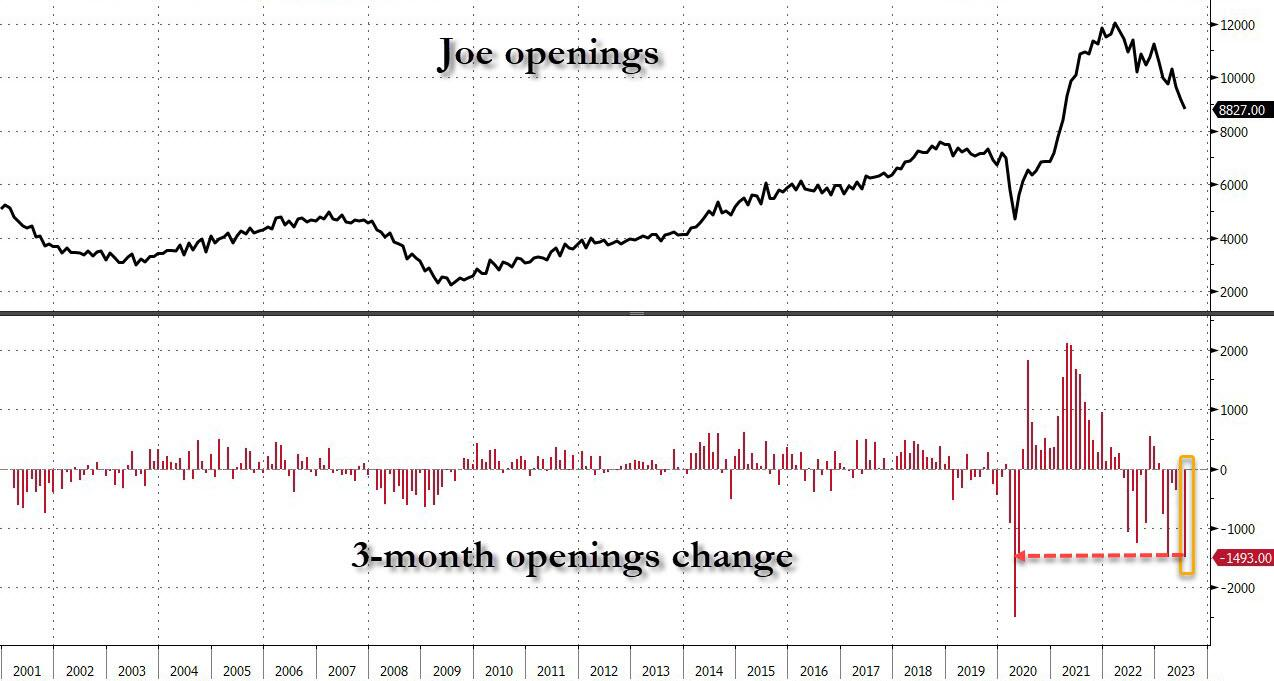

Driving the news: The latest Job Openings and Labor Turnover Survey (JOLTS) suggests the ideal labor market rebalancing that Fed policymakers want is underway. Vacancies are easing without a big jump in unemployment.

But it also suggests that the era of heightened worker power — as indicated by an elevated quits rate — might be near its end.

Details: There were 8.8 million job openings in July, a decrease of 338,000 compared to the prior month. That means there were 1.5 open jobs for every unemployed worker, the lowest ratio since Sept. 2021.

Meanwhile, the hiring rate ticked down by 0.1% to 3.7%, in step with the pre-pandemic hiring rate.

The layoff rate held at a low 1% for the fourth straight month.

The intrigue: Remember the Great Resignation? In July, the quits rate was 2.3%, the lowest since January 2021, matching the months before the pandemic.The quits rate among private sector workers fell to 2.5%, well below the most recent peak of 3.3% in April 2022.

The indicator is the latest sign that the COVID-era quitting frenzy looks to be in the past.

The bottom line: "While most Americans who want a job have one, it is not as easy to find new work as a year ago. Hires and quits are back to their pre-pandemic levels, and job openings are falling rapidly," Bill Adams, chief economist at Comerica Bank, wrote in a note.

-

You know, I'm not a chart and numbers guy. I think that stuff is pretty good for looking where you've been and pretty lousy at predicting the future, ranging from mildly bad in the short term to abysmal in the long term. Guess that's why I ain't rich.

In a broad sense, an economy is made up of, and run by, people. People can be very illogical. They often do not consult charts, data tables or even astrologers before arriving at a conclusion. Admittedly, I'm a regional guy, without the varied experiences of my well traveled fellow TNCR members.

So ...Speaking for my part of the world, people think the economy sucks. They are just making ends meet and are very scared about inflation and purchasing power. The talk around the water cooler is about grocery store prices, how much a car costs now, rising insurance costs and deductibles, and whether they or their kids can afford a house mortgage.

Perception becomes reality. The economy is not going to flourish, because people doubt that it can. Pessimism has trumped optimism.

With nary a chart in sight...

-

You know, I'm not a chart and numbers guy. I think that stuff is pretty good for looking where you've been and pretty lousy at predicting the future, ranging from mildly bad in the short term to abysmal in the long term. Guess that's why I ain't rich.

In a broad sense, an economy is made up of, and run by, people. People can be very illogical. They often do not consult charts, data tables or even astrologers before arriving at a conclusion. Admittedly, I'm a regional guy, without the varied experiences of my well traveled fellow TNCR members.

So ...Speaking for my part of the world, people think the economy sucks. They are just making ends meet and are very scared about inflation and purchasing power. The talk around the water cooler is about grocery store prices, how much a car costs now, rising insurance costs and deductibles, and whether they or their kids can afford a house mortgage.

Perception becomes reality. The economy is not going to flourish, because people doubt that it can. Pessimism has trumped optimism.

With nary a chart in sight...

@Jolly said in Zero Hedge - fudging the numbers:

You know, I'm not a chart and numbers guy. I think that stuff is pretty good for looking where you've been and pretty lousy at predicting the future, ranging from mildly bad in the short term to abysmal in the long term.

LOL That is so true. I had a friend who started a precious metals trading firm. He developed this algorithm and back tested it with historical data so it was perfect.

Imagine his surprise when the future was not exactly like the past and his algorithm was not as good as he thought.

-

@Jolly said in Zero Hedge - fudging the numbers:

You know, I'm not a chart and numbers guy. I think that stuff is pretty good for looking where you've been and pretty lousy at predicting the future, ranging from mildly bad in the short term to abysmal in the long term.

LOL That is so true. I had a friend who started a precious metals trading firm. He developed this algorithm and back tested it with historical data so it was perfect.

Imagine his surprise when the future was not exactly like the past and his algorithm was not as good as he thought.

-

@George-K 555

-

That's one fucking ugly website. There's so many graphs and tables of data I just lost the will to live. Thank God for all the commercials getting in the way.

And what is this one intended to report exactly?