Bidenomics At Work

-

@Jolly said in Bidenomics At Work:

Maybe you need to show your numbers to more people...

Who you gonna believe, the government or your own lying checkbook?

@George-K said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Maybe you need to show your numbers to more people...

Who you gonna believe, the government or your own lying checkbook?

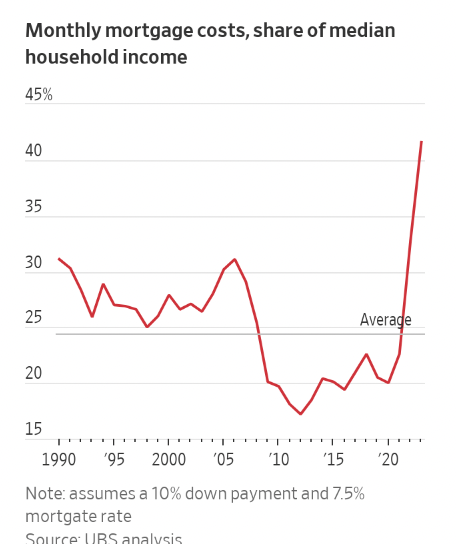

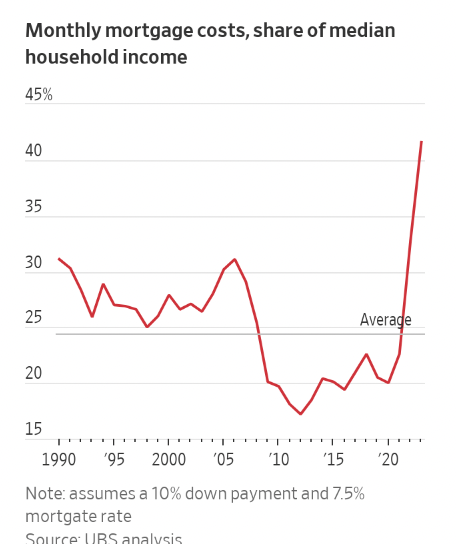

Note the assumptions below the graph — the graph does not reflect what people actually pay, only hypothetical based on certain assumptions.

-

Right, also the vast majority of existing mortgages were not written since the interest rate hikes.

That graph shows an important problem, namely the formidable challenges for young household formation. But it isn’t tracking the experiences of average households.

-

I think that it’s impacting more people than you think. There were around 3,000,000 residential mortgages processed this year. Now granted, that number is WAAAAAAYYYY down, but 3,000,000 is still 3% of US households and we still need the data for the 3rd quarter. By the end of the year we could be approaching 6% of households. There were also around 8,000,000 new mortgages executed in 2022. The interest rates weren’t quite where they are today, but are damn close. Now let’s add on pre-existing ARMS. That accounts for approximately 3% of existing mortgages prior to the rate hikes. So how many more households does that add?

Now, let’s talk about Commercial Mortgages. Landlords normally finance their investment properties, and many use ARMS. There’s been a lot of talk and aspersions cast on landlords recently, blaming greed for rising rents and ignoring the fact that there are hundreds of thousands of property owners that still haven’t been able to collect back COVID rent, are facing significantly higher maintenance costs, and are between a rock and a hard place on their mortgages.

Now let’s talk about home equity lines of credit… Or families that were planning on refinancing to help pay for needed repairs and such?

How many industries are strongly reliant on the housing market? Hell, even the piano industry is strongly affected by the housing market.

No, this is affecting millions and millions of households. My bet is close to half of US households are being hurt. This is a lot bigger than just the Gen Z’s that are having to hold off on purchasing due to the interest rates.

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

-

Oh, and while it’s great that oil production has recovered from COVID and the early Biden Admin policies, most Americans aren’t as concerned about the actual levels of production as they are about the actual costs of fuel. And the fact remains that fuel is still extremely expensive and a larger burden in the typical family than it was 4 years ago.

-

I think that it’s impacting more people than you think. There were around 3,000,000 residential mortgages processed this year. Now granted, that number is WAAAAAAYYYY down, but 3,000,000 is still 3% of US households and we still need the data for the 3rd quarter. By the end of the year we could be approaching 6% of households. There were also around 8,000,000 new mortgages executed in 2022. The interest rates weren’t quite where they are today, but are damn close. Now let’s add on pre-existing ARMS. That accounts for approximately 3% of existing mortgages prior to the rate hikes. So how many more households does that add?

Now, let’s talk about Commercial Mortgages. Landlords normally finance their investment properties, and many use ARMS. There’s been a lot of talk and aspersions cast on landlords recently, blaming greed for rising rents and ignoring the fact that there are hundreds of thousands of property owners that still haven’t been able to collect back COVID rent, are facing significantly higher maintenance costs, and are between a rock and a hard place on their mortgages.

Now let’s talk about home equity lines of credit… Or families that were planning on refinancing to help pay for needed repairs and such?

How many industries are strongly reliant on the housing market? Hell, even the piano industry is strongly affected by the housing market.

No, this is affecting millions and millions of households. My bet is close to half of US households are being hurt. This is a lot bigger than just the Gen Z’s that are having to hold off on purchasing due to the interest rates.

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

@LuFins-Dad said in Bidenomics At Work:

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

Not really. It's a global phenomenon. If you think it's bad trying to find affordable housing here, try the UK and Canada

-

The average American voter doesn't give a fig about the global economy. They do care about their kitchen table issues. Things like the price of fuel, food, clothing, utilities and how much they'd like to get rid of their hooptie ride and buy a decent used car or a new one, but they can't afford it

-

@LuFins-Dad said in Bidenomics At Work:

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

Not really. It's a global phenomenon. If you think it's bad trying to find affordable housing here, try the UK and Canada

@Doctor-Phibes said in Bidenomics At Work:

@LuFins-Dad said in Bidenomics At Work:

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

Not really. It's a global phenomenon.

US Dollar is the most commonly traded currency in the world, at a rate three times the Euro, the next most common. So yes, what happens to the US Dollar, and the actions of the Fed have significant global impact. When the Fed dumps $3 TRILLION into the global economy, it’s going to impact everyone. Plus, the EU and other currencies followed suit later in 2020 and 2021, which exacerbated the issues, but make no mistake… The US has the largest economy in the world. In fact, you would need to add the economies of Japan, Germany, India, the UK, France, Italy, Canada, and South Korea to match it. So when it gets sick, everyone suffers.

-

Yes, obviously America has a big influence - the old cliche America sneezes, the world catches a cold has a lot of truth to it.

However, unaffordable housing and high oil prices, which is what were talking about, are down to a lot more than the US. Despite what some politicians might claim, American oil production isn't the primary driver behind oil price.

And a lot of what we're suffering from now is a direct consequence of the Covid epidemic.

-

-

But would not the Biden administration want to have lower jobs reported rather than higher jobs numbers? With increased jobs, then there is a higher chance that the US interest rates will continue to be raised. I would think that the Biden administration would want the rates to be decreased.

-

The

Biden administrationBLS has revised down previously reported jobs data for nearly every month this year, resulting in a huge disparity from the originally advertised numbers, according to the Bureau of Labor Statistics (BLS)..The BLS have their methods, administrations come and go.

-

The

Biden administrationBLS has revised down previously reported jobs data for nearly every month this year, resulting in a huge disparity from the originally advertised numbers, according to the Bureau of Labor Statistics (BLS)..The BLS have their methods, administrations come and go.

-

@jon-nyc said in Bidenomics At Work:

The BLS have their methods, administrations come and go.

Which raises the question: Has BLS revised numbers in the past, and if so, how often?

@George-K said in Bidenomics At Work:

@jon-nyc said in Bidenomics At Work:

The BLS have their methods, administrations come and go.

Which raises the question: Has BLS revised numbers in the past, and if so, how often?

Yes, the BLS has been making revisions for a very long time (my memory of that goes as far back to when Clinton was President, won't surprise me if that practice stretches back even further). It's a publicly documented practice, see https://www.bls.gov/bls/empsitquickguide.htm , look for the section under "Monthly Revisions."

Srsly, one may quibble over specific methods, but having a revision practice in place is the right thing to do to balance "timelines" and "accuracy." The BLS has that and discloses it; has been that way for a very long time.

-

@jon-nyc said in Bidenomics At Work:

The BLS have their methods, administrations come and go.

Which raises the question: Has BLS revised numbers in the past, and if so, how often?

@George-K said in Bidenomics At Work:

@jon-nyc said in Bidenomics At Work:

The BLS have their methods, administrations come and go.

Which raises the question: Has BLS revised numbers in the past, and if so, how often?

I think they literally always revise them There are things that are estimated in the first pass that can be measured in the second.

-

There have been 7 downward revisions and 1 upward revisions through August.

In 2022 there were 7 upward revisions and 5 down.

In 2021 there were 11 upward revisions and 1 downwards.

So the majority of months since his inauguration the BLS underestimated the sheer awesomeness of Bidenomics.

-

There have been 7 downward revisions and 1 upward revisions through August.

In 2022 there were 7 upward revisions and 5 down.

In 2021 there were 11 upward revisions and 1 downwards.

So the majority of months since his inauguration the BLS underestimated the sheer awesomeness of Bidenomics.

@jon-nyc said in Bidenomics At Work:

There have been 7 downward revisions and 1 upward revisions through August.

In 2022 there were 7 upward revisions and 5 down.

In 2021 there were 11 upward revisions and 1 downwards.

So the majority of months since his inauguration the BLS underestimated the sheer awesomeness of Bidenomics.

Therefore, lies are ok?