Bidenomics At Work

-

@Jolly try https://www.marketwatch.com/story/more-people-are-working-multiple-jobs-as-americans-battle-high-prices-and-layoff-jitters-4da47ab3

Multiple jobholders reached 8,137,000 in March, or 5.1% of the total employed population ...

Historical comparison:

But the March level was still lower than the pre-pandemic level of 8,181,000 million in February 2020 at 5.2% of the total employed population.

-

On "working more than one job", generally I expect that to increase over time as it has become easier for people to take up "side gigs." Anyone can sign up to drive drive ride-shares (Uber, Lyft), deliver food/grocery (GrubHub, Postmates, DoorDash), take on various tasks (Fiverr, TaskRabbit, FlexJobs). The trend started before Biden and will continue with or without Biden, domestically and internationally.

-

Maybe you need to show your numbers to more people...

-

@Jolly said in Bidenomics At Work:

Yep, explains one of the lowest approval ratings in modern times..

Show you blockbuster jobs report, you not happy.

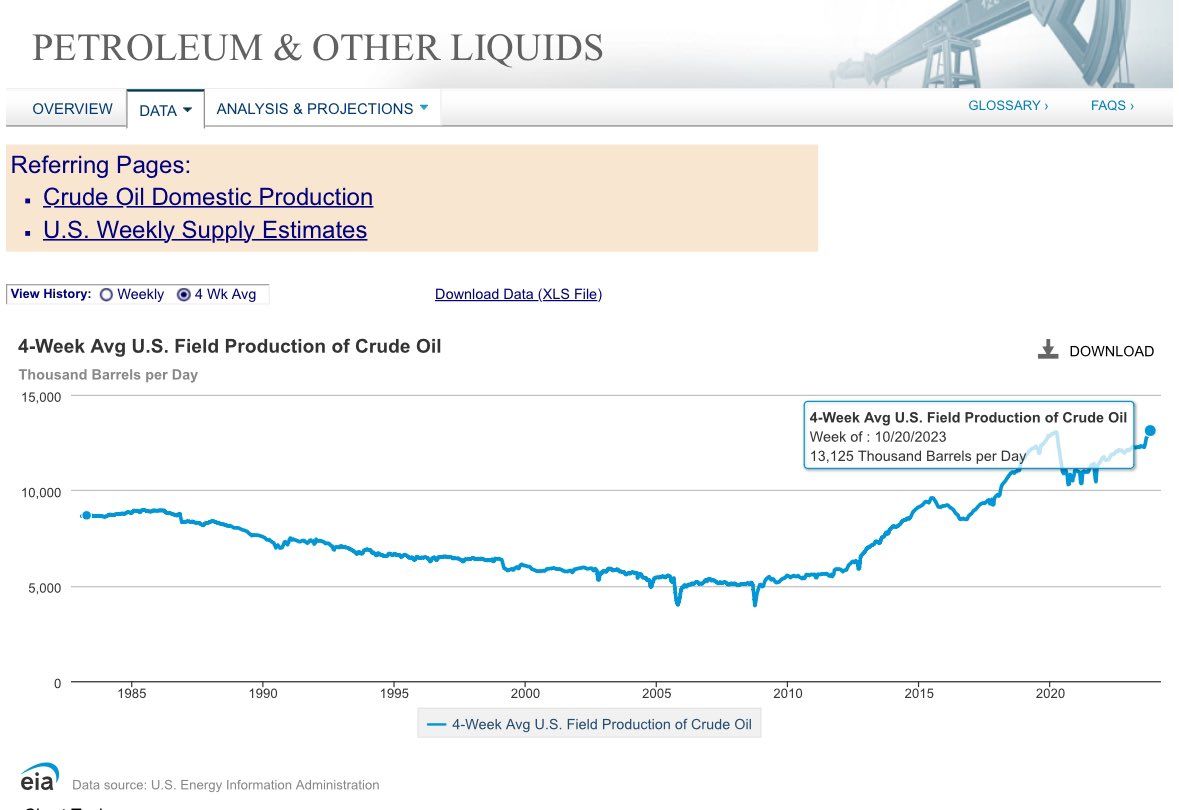

Show you great oil production report, you not happy.Biden Derangement Syndrome.

@Axtremus said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Yep, explains one of the lowest approval ratings in modern times..

Show you blockbuster jobs report, you not happy.

Show you great oil production report, you not happy.Biden Derangement Syndrome.

When they are from your "side", good things are because of them and bad things are in spite of them.

When they are from the other "side", good things are in spite of them, and bad things are because of them.

President Trump could have personally come up with a cure for all cancers, and the Democrats would still have found something with that to blame on him (why didn't he do this earlier? Too expensive! Great, cured cancer, but doesn't he care about high blood pressure?)

-

Maybe you need to show your numbers to more people...

-

@Jolly said in Bidenomics At Work:

Maybe you need to show your numbers to more people...

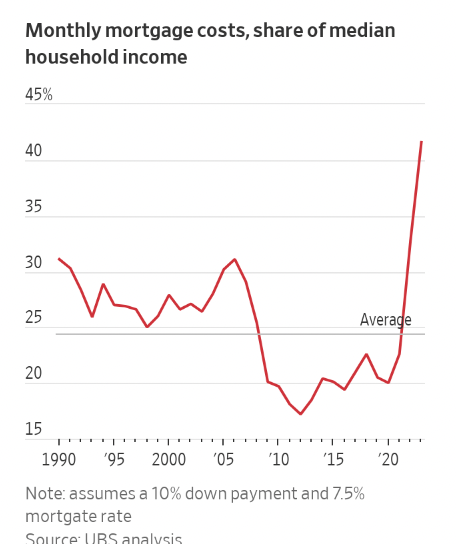

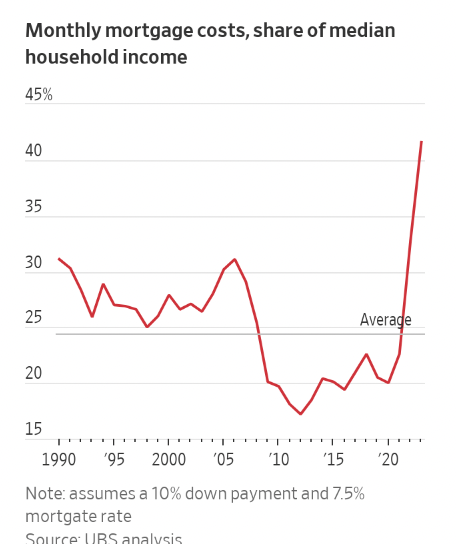

Who you gonna believe, the government or your own lying checkbook?

@George-K said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Maybe you need to show your numbers to more people...

Who you gonna believe, the government or your own lying checkbook?

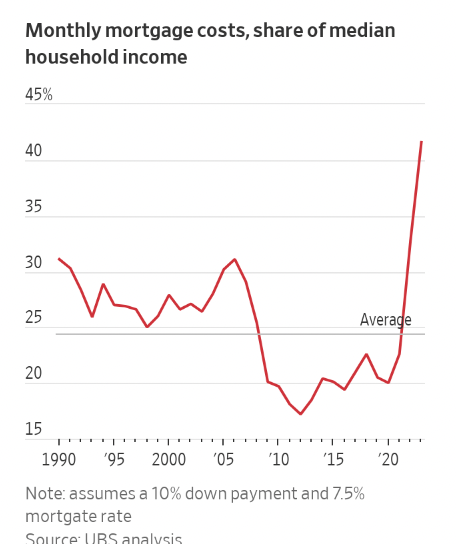

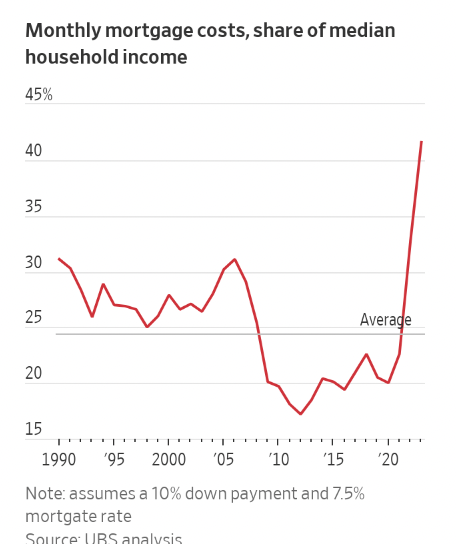

What's the old rule of thumb? 20 or 25% of income?

-

@Jolly said in Bidenomics At Work:

Maybe you need to show your numbers to more people...

Who you gonna believe, the government or your own lying checkbook?

@George-K said in Bidenomics At Work:

@Jolly said in Bidenomics At Work:

Maybe you need to show your numbers to more people...

Who you gonna believe, the government or your own lying checkbook?

Note the assumptions below the graph — the graph does not reflect what people actually pay, only hypothetical based on certain assumptions.

-

Right, also the vast majority of existing mortgages were not written since the interest rate hikes.

That graph shows an important problem, namely the formidable challenges for young household formation. But it isn’t tracking the experiences of average households.

-

I think that it’s impacting more people than you think. There were around 3,000,000 residential mortgages processed this year. Now granted, that number is WAAAAAAYYYY down, but 3,000,000 is still 3% of US households and we still need the data for the 3rd quarter. By the end of the year we could be approaching 6% of households. There were also around 8,000,000 new mortgages executed in 2022. The interest rates weren’t quite where they are today, but are damn close. Now let’s add on pre-existing ARMS. That accounts for approximately 3% of existing mortgages prior to the rate hikes. So how many more households does that add?

Now, let’s talk about Commercial Mortgages. Landlords normally finance their investment properties, and many use ARMS. There’s been a lot of talk and aspersions cast on landlords recently, blaming greed for rising rents and ignoring the fact that there are hundreds of thousands of property owners that still haven’t been able to collect back COVID rent, are facing significantly higher maintenance costs, and are between a rock and a hard place on their mortgages.

Now let’s talk about home equity lines of credit… Or families that were planning on refinancing to help pay for needed repairs and such?

How many industries are strongly reliant on the housing market? Hell, even the piano industry is strongly affected by the housing market.

No, this is affecting millions and millions of households. My bet is close to half of US households are being hurt. This is a lot bigger than just the Gen Z’s that are having to hold off on purchasing due to the interest rates.

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

-

Oh, and while it’s great that oil production has recovered from COVID and the early Biden Admin policies, most Americans aren’t as concerned about the actual levels of production as they are about the actual costs of fuel. And the fact remains that fuel is still extremely expensive and a larger burden in the typical family than it was 4 years ago.

-

I think that it’s impacting more people than you think. There were around 3,000,000 residential mortgages processed this year. Now granted, that number is WAAAAAAYYYY down, but 3,000,000 is still 3% of US households and we still need the data for the 3rd quarter. By the end of the year we could be approaching 6% of households. There were also around 8,000,000 new mortgages executed in 2022. The interest rates weren’t quite where they are today, but are damn close. Now let’s add on pre-existing ARMS. That accounts for approximately 3% of existing mortgages prior to the rate hikes. So how many more households does that add?

Now, let’s talk about Commercial Mortgages. Landlords normally finance their investment properties, and many use ARMS. There’s been a lot of talk and aspersions cast on landlords recently, blaming greed for rising rents and ignoring the fact that there are hundreds of thousands of property owners that still haven’t been able to collect back COVID rent, are facing significantly higher maintenance costs, and are between a rock and a hard place on their mortgages.

Now let’s talk about home equity lines of credit… Or families that were planning on refinancing to help pay for needed repairs and such?

How many industries are strongly reliant on the housing market? Hell, even the piano industry is strongly affected by the housing market.

No, this is affecting millions and millions of households. My bet is close to half of US households are being hurt. This is a lot bigger than just the Gen Z’s that are having to hold off on purchasing due to the interest rates.

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

@LuFins-Dad said in Bidenomics At Work:

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

Not really. It's a global phenomenon. If you think it's bad trying to find affordable housing here, try the UK and Canada

-

The average American voter doesn't give a fig about the global economy. They do care about their kitchen table issues. Things like the price of fuel, food, clothing, utilities and how much they'd like to get rid of their hooptie ride and buy a decent used car or a new one, but they can't afford it

-

@LuFins-Dad said in Bidenomics At Work:

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

Not really. It's a global phenomenon. If you think it's bad trying to find affordable housing here, try the UK and Canada

@Doctor-Phibes said in Bidenomics At Work:

@LuFins-Dad said in Bidenomics At Work:

And all brought to us courtesy of The Trump and Biden Administrations, both administrations FED Appointees, and the last two Congresses

Not really. It's a global phenomenon.

US Dollar is the most commonly traded currency in the world, at a rate three times the Euro, the next most common. So yes, what happens to the US Dollar, and the actions of the Fed have significant global impact. When the Fed dumps $3 TRILLION into the global economy, it’s going to impact everyone. Plus, the EU and other currencies followed suit later in 2020 and 2021, which exacerbated the issues, but make no mistake… The US has the largest economy in the world. In fact, you would need to add the economies of Japan, Germany, India, the UK, France, Italy, Canada, and South Korea to match it. So when it gets sick, everyone suffers.

-

Yes, obviously America has a big influence - the old cliche America sneezes, the world catches a cold has a lot of truth to it.

However, unaffordable housing and high oil prices, which is what were talking about, are down to a lot more than the US. Despite what some politicians might claim, American oil production isn't the primary driver behind oil price.

And a lot of what we're suffering from now is a direct consequence of the Covid epidemic.

-

-

But would not the Biden administration want to have lower jobs reported rather than higher jobs numbers? With increased jobs, then there is a higher chance that the US interest rates will continue to be raised. I would think that the Biden administration would want the rates to be decreased.

-

The

Biden administrationBLS has revised down previously reported jobs data for nearly every month this year, resulting in a huge disparity from the originally advertised numbers, according to the Bureau of Labor Statistics (BLS)..The BLS have their methods, administrations come and go.