SVB Contagion?

-

@Doctor-Phibes said in SVB Contagion?:

I'm not making any decisions until I hear what Jim Cramer has to slur about it.

He sounds like he had a stroke.

@Horace said in SVB Contagion?:

@Doctor-Phibes said in SVB Contagion?:

I'm not making any decisions until I hear what Jim Cramer has to slur about it.

He sounds like he had a stroke.

It's hard to believe that somebody as serene as that guy could possibly have high blood pressure.

-

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

@Axtremus said in SVB Contagion?:

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

It was one of the few major banks in the world that needed and received no government money during the financial crisis.

But that was when I was there.

-

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

@Axtremus said in SVB Contagion?:

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

Their security is full of holes?

-

-

https://www.fdic.gov/news/press-releases/2023/pr23021.html

"Subsidiary of New York Community Bancorp, Inc., to Assume Deposits of Signature Bridge Bank, N.A., From the FDIC"

-

-

Cute and all but:

-

Banks like that $3 overdraft, they get to charge her $20 for it.

-

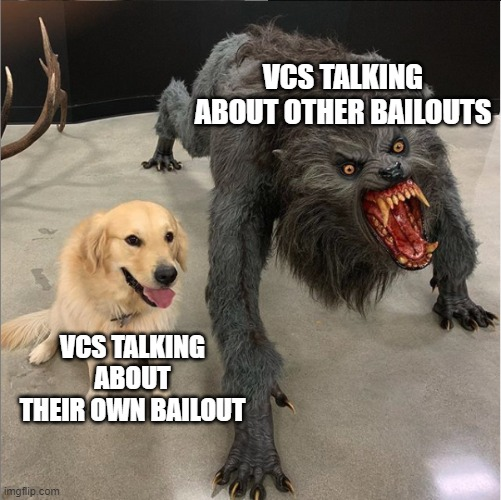

SVB didn’t get money. The executives all lose their jobs and the shareholders are zeroed out. The depositors got made whole.

-

-

Cute and all but:

-

Banks like that $3 overdraft, they get to charge her $20 for it.

-

SVB didn’t get money. The executives all lose their jobs and the shareholders are zeroed out. The depositors got made whole.

@jon-nyc said in SVB Contagion?:

- SVB didn’t get money. The executives all lose their jobs and the shareholders are zeroed out. ...

Pending investigation, perhaps there should be claw-backs of their recent performance-based bonuses and stock awards too. They should not get to keep short-term gains from poor risk management practices.

-