SVB Contagion?

-

This is from the RWEC, but it's pretty free of politics. Just a nice (?) distillation of how bad this could be:

HO-LEE-SMOKES and pucker up.

It’s barely 24 hours later and what’s shaking out so far is pretty scary. Is the federal reserve ready to handle something of this magnitude? Janet Yellen? Forces are already in motion trying to mitigate some of the damage and panic sure to ensue when the financial markets and banks open Monday morning, but there’s turning out to be an awful lot of scrambling to CYA.

One top investment bank sent a note to clients advising what could happen if no buyers steps in, according to a transcription reviewed by The Post.

The note outlined how the FDIC is spending the weekend assessing the value of SVB’s assets. It will pay out up to $250,000 in insurance coverage for accounts at that level or below on Monday. The agency will also make a payment, called an advanced dividend, to uninsured depositors as quickly as possible.

“The rest may take anywhere from 60 days to 2 years to get paid out,” the note said, adding that companies waiting for payouts will find investors and lenders available to try to finance the amounts the FDIC says they will get. Ultimately SVB clients could get 80 to 90 cents for each dollar they had on deposit, but it could take years for that to happen.

And that may be too late for many small businesses with ties to the bank.

Uninsured – over $250K – investors “could” see 80-90¢ on the dollar. That’s a mighty big “could.”

In England, the new Bank of London was mulling a possible offer to buy SVB’s London branch, and not because it was a bargain. They’re thinking the British tech sector may go down with the ship if they don’t have a rescue plan in place.

Sky News has learnt that The Bank of London (TBOL), which recently raised funds at a valuation of over $1bn, is considering making an offer for SVB UK.

News of its interest comes hours after the Bank of England said it planned to use a bank insolvency procedure to take control of the British operation, which counts thousands of UK start-ups among its clients.

…On Saturday, dozens of early-stage companies were writing to Jeremy Hunt, the chancellor, to warn of “an existential threat to the UK tech sector”.

…”The majority of the most exciting and dynamic tech businesses bank with SVB and have no or limited diversity in where their deposits are held,” the draft letter said.

“This weekend the majority of us as tech founders are running numbers to see if we are potentially technically insolvent.

“The impact of this is far greater than our individual businesses.

“The Bank of England’s assessment that SVB going into administration would have limited impact on the UK economy displays a dangerous lack of understanding of the sector and the role it plays in the wider economy, both today and in the future.”

…”Many businesses will be sent into involuntary liquidation overnight,” they wrote.Here in the States, the reach of the failure isn’t just depositors and tech companies. It’s online marketplaces like Etsy, that used their payment processing. Now those people can’t be paid for sales from the website. A toy store chain in New York City is begging people to come buy toys for 40% off using a special code, so they can at least generate some sort of cash flow, or they’ll go under.

…The venture capital-backed retailer Camp fired off an email Friday to customers, saying it was slashing prices and plans to use sales revenue to continue operating, after much of its cash was tied up in the second-biggest bank casualty in U.S. history.

“Unfortunately, we had most of our company’s cash assets at a bank which just collapsed. I’m sure you’ve heard the news,” co-founder Ben Kaufman said in an email to customers, according to CNN.

Kaufman asked customers to use the code “BANKRUN” to save 40% off all merchandise — a likely nod to the run on the bank that may have helped bring down the Silicon Valley lender. The company also said customers could pay full price, adding that would be appreciated.

Better drink up, Shriners, while you can. SVB was THE bank for the better part of the wineries in California…thousands of wineries.

The wine industry is facing an unprecedented financial crisis amid the fallout of Silicon Valley Bank, the leading bank for California wineries.

Silicon Valley Bank was closed Friday by the California Department of Financial Protection and Innovation after a bank run by its venture capital customers. For nearly 30 years, the bank has been the go-to financial institution for the California wine industry. But now, an estimated thousands of wineries are locked out of their Silicon Valley Bank accounts — and they don’t know if, or when, they’ll get access to their money.

Kendra Kawala, the co-founder of Maker, a Bay Area canned wine company, called the news “jarring” as Silicon Valley Bank has been “the gold standard within the wine industry.” When she started Maker four years ago, “it was almost a no-brainer who the right banking partner was.”

A new bank, the National Bank of Santa Clara, has been created by the Federal Deposit Insurance Corp. to hold the deposits and assets of Silicon Valley Bank, and it will begin operating by Monday. But only accounts that fall below $250,000 are insured by FDIC; any winery with funds above that will have to wait an undetermined amount of time to find out if the additional amount will be paid back, partially or in full.

Roku has $487M in cash in SVB. Well…had. At least they’d spread the love out.

…Nonetheless, Roku said it believed it would be able to meet its capital obligations for the “next twelve months and beyond” with its unaffected $1.4 billion in cash reserves at other “large financial institutions.”

Part of the problem, as my little brother the banker explained to me, is that after the 2008 meltdown, the number of banks in the country shrank exponentially. So, while 2008 was awful, there was enough give in the system for it to be absorbed – banks were left standing who could buy the assets of failed banks. That flex is no longer available. The number has shrunk, so when one goes, it’s going to hurt much worse, especially something on this unimaginable scale.

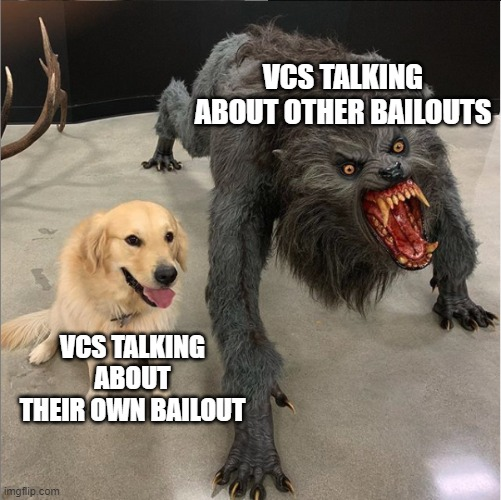

“Let them go” has a huge, completely reasonable and utterly understandable following.

Home Depot co-founder torches ‘woke’ Silicon Valley Bank collapse, warns recession may be here already

Banks are more concerned with ‘global warming’ than shareholder returns, Bernie Marcus argued…”I feel bad for all of these people that lost all their money in this woke bank. You know, it was more distressing to hear that the bank officials sold off their stock before this happened. It’s depressing to me. Who knows whether the Justice Department would go after them? They’re a woke company, so I guess not. And they’ll probably get away with it,” he said to host Neil Cavuto.

…”Instead of protecting the shareholders and their employees, they are more concerned about the social policies. And I think it’s probably a badly run bank. They’ve been there for a lot of years. It’s pathetic that so many people lost money that won’t get it back.”

If you had to give it a cover song, I guess “Won’t Get Fooled Again” would be the first choice of a majority.

-

God-King Musk will save us…

-

God-King Musk will save us…

-

I've long thought that we spent up our cushion in 2008-9. I was amazed we could come up with the COVID

excessesspending. -

I'm not making any decisions until I hear what Jim Cramer has to slur about it.

-

I'm not making any decisions until I hear what Jim Cramer has to slur about it.

@Doctor-Phibes said in SVB Contagion?:

I'm not making any decisions until I hear what Jim Cramer has to slur about it.

He sounds like he had a stroke.

-

@Doctor-Phibes said in SVB Contagion?:

I'm not making any decisions until I hear what Jim Cramer has to slur about it.

He sounds like he had a stroke.

@Horace said in SVB Contagion?:

@Doctor-Phibes said in SVB Contagion?:

I'm not making any decisions until I hear what Jim Cramer has to slur about it.

He sounds like he had a stroke.

It's hard to believe that somebody as serene as that guy could possibly have high blood pressure.

-

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

@Axtremus said in SVB Contagion?:

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

It was one of the few major banks in the world that needed and received no government money during the financial crisis.

But that was when I was there.

-

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

@Axtremus said in SVB Contagion?:

What's with Credit Suisse? It seems to get into trouble more frequently than other international investment mega banks. :man-shrugging:

Their security is full of holes?

-

-

https://www.fdic.gov/news/press-releases/2023/pr23021.html

"Subsidiary of New York Community Bancorp, Inc., to Assume Deposits of Signature Bridge Bank, N.A., From the FDIC"