Property Taxes

-

In Crook County, IL, you pay your property taxes for the PRECEEDING year. IOW, when I paid my property taxes a few weeks ago, they were for 2021. The taxes are paid in two installments, usually once in March and once in September (this year's bill were delayed by incompetence, so I paid it in December).

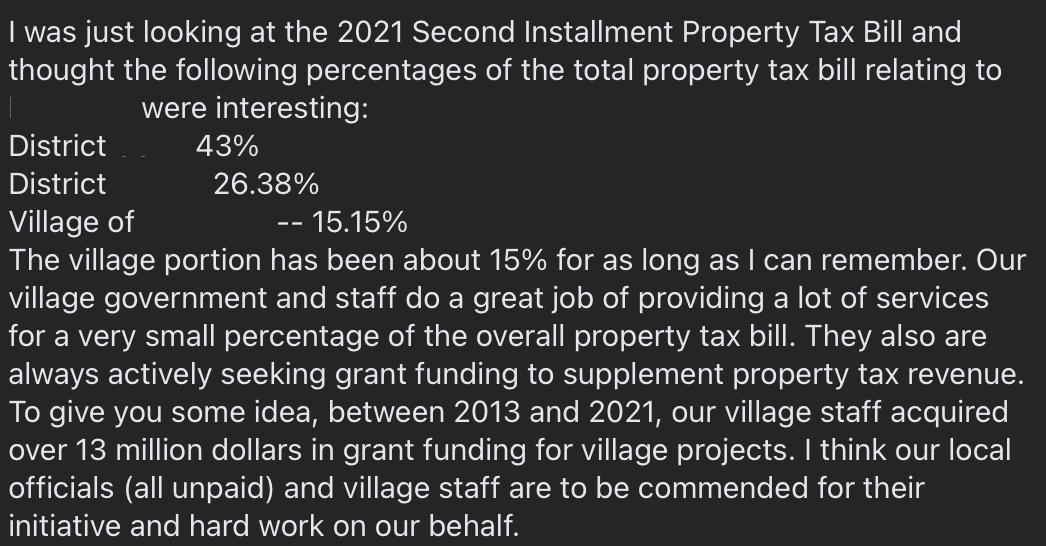

This came through in my FB feed from my town.

About 70% of my tax bill goes to the local school districts. As posted, 15% to the town, and the balance to other places in Crook County. The person who posted it is a former village president, so he knows his numbers.

Is that typical?

-

The breakdown here is roughly 2/3 school tax, and 1/6 each to village and county.

Some variation is due to where the line is drawn between state and local funding. Next door in CT, for example, the state funds municipal retirement expenses so local taxes only pay operating costs. Not so in NY.