SBF/FTX

-

Here's 100 year old public intellectual Charlie Munger's take:

98-year old billionaire Charlie Munger, a long time critic of crypto, called digital currencies a combination of delusion and fraud in the wake of the blowup of exchange FTX.

“You are seeing a lot of delusion," Munger, vice chairman of Berkshire Hathaway (NYSE:BRK.B), said in a CNBC interview. "Partly fraud and partly delusion. That’s a bad combination."

Bahamas-headquartered FTX filed for Chapter 11 bankruptcy on November 11 after traders rushed to withdraw billions of dollars from the platform in the wake of its multi-billion dollar shortfall.

“This is a very, very bad thing," Munger said. "The country did not need a currency that was good for kidnappers. There are people who think they’ve got to be on every deal that’s hot. I think that’s totally crazy. They don’t care whether it’s child prostitution or bitcoin.”

The once multibillion dollar exchange is under investigation by the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, and the Justice Department.

“Good ideas, carried to wretched excess, become bad ideas,” Munger told CNBC. “Nobody’s gonna say I got some s*** that I want to sell you. They say – it’s blockchain!”

-

Everyone he donated money to could be subject to clawback litigation, just like what happened with Madoff. Of course litigants will choose entities with resources to pay back. The remaining assets of his PAC - if there are any - would be subject to clawback, but the money the PAC already spent on behalf of candidates is gone and unrecoverable.

Where this will really matter is with his charitable giving. It won't be very entertaining to watch legit charities being sued, but it's going to happen.

-

@Jolly that would be our money, dude.

-

I heard they’d approve or reject corporate matters with emojis….

-

@Jolly that would be our money, dude.

-

@jon-nyc no, I misinterpreted Jolly’s comment.

-

@jon-nyc no, I misinterpreted Jolly’s comment.

@Ivorythumper whew!

I didn’t take you for a crypto bro. Lol

-

-

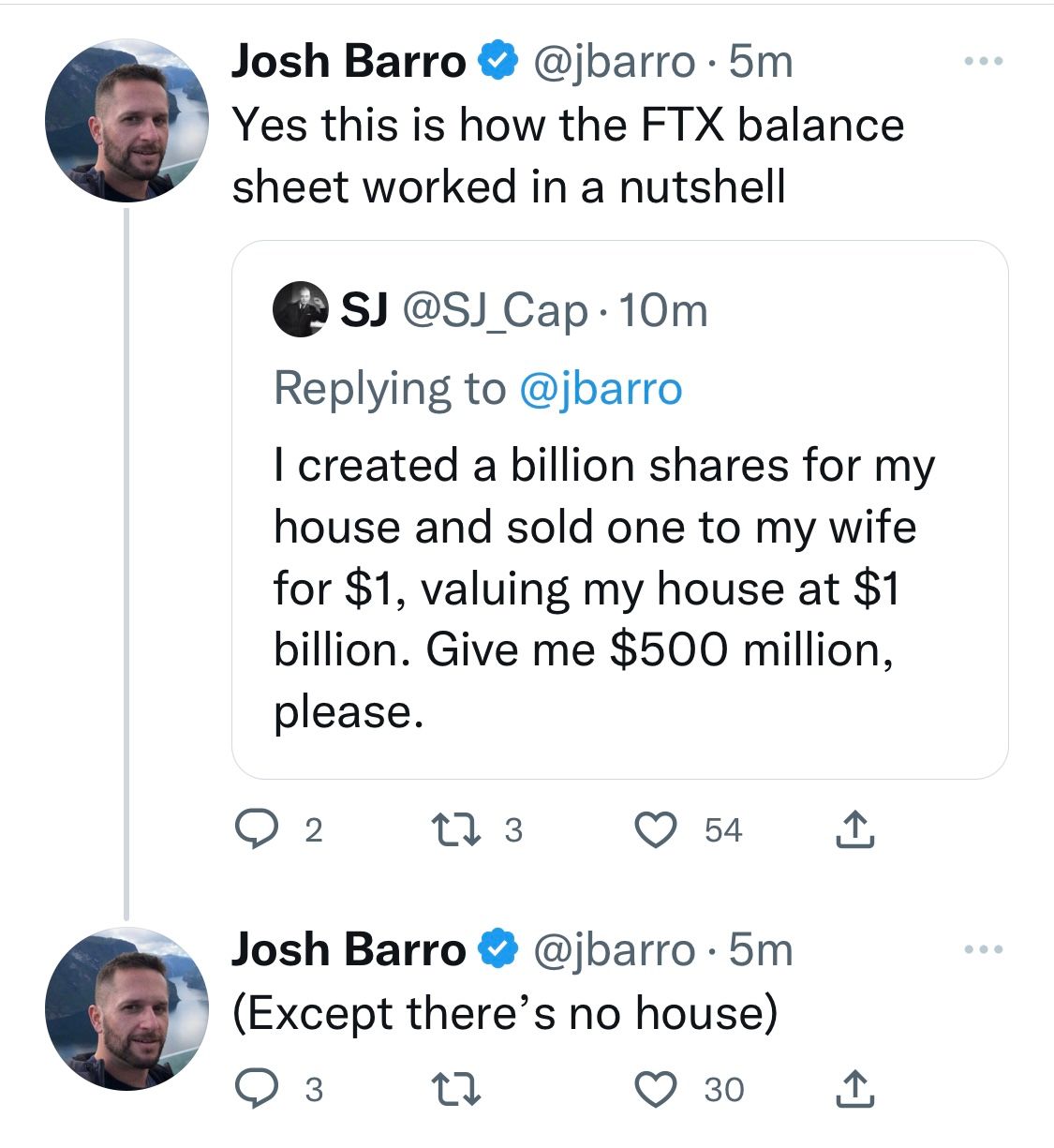

I still don’t understand any of this.

It sounds like maybe I’m not alone

-

@Ivorythumper whew!

I didn’t take you for a crypto bro. Lol

@Ivorythumper whew!

I didn’t take you for a crypto bro. Lol

We can’t in the house due to MS’s work restrictions.

Good thing— I started seriously thinking about it exactly 1 year ago!

-

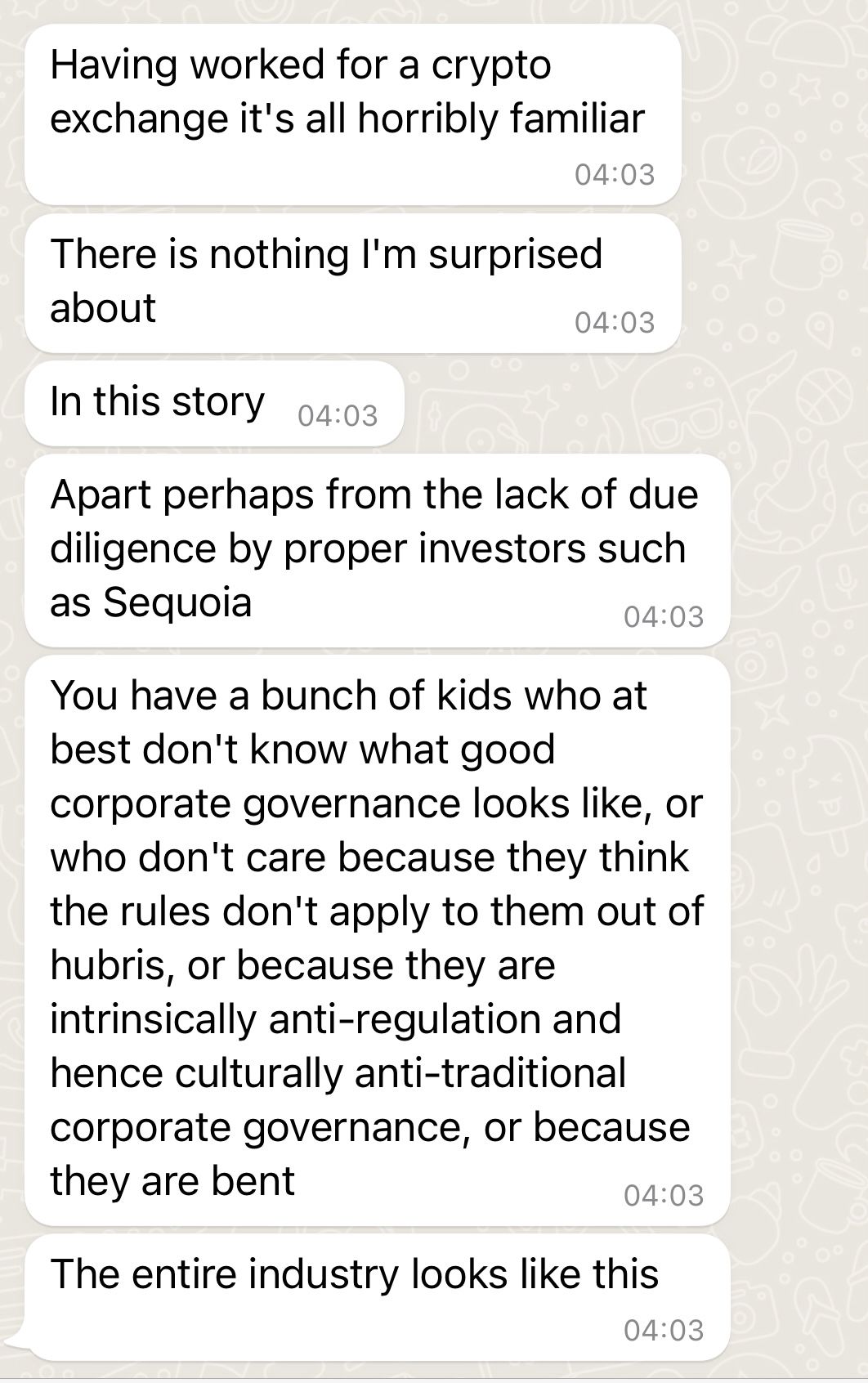

Yeah, just recently a Sequoia guy said it has done "careful due diligence" on FTX and "there's nothing much we could have done any differently."

SoftBank also invested in FTX but it’s the VC that has also lost a ton of money in WeWork, so I suppose it doesn’t quite qualify as “proper investor” as much as Sequoia.

-

If the company had its own boutique crypto currency which was valued at the most recent transaction price, which in turn was whatever SBF wanted it to be, then I suppose the bubble pop makes sense. But that would be the pop of a bubble that wasn’t inflated with real money to begin with. My question is where did all the real money go? I mean other to Democrats, as SBF tried to climb socially through the high status political ranks of the left.

-

If the company had its own boutique crypto currency which was valued at the most recent transaction price, which in turn was whatever SBF wanted it to be, then I suppose the bubble pop makes sense. But that would be the pop of a bubble that wasn’t inflated with real money to begin with. My question is where did all the real money go? I mean other to Democrats, as SBF tried to climb socially through the high status political ranks of the left.

@Horace The immediate answer is Alameda but it's still unclear what they were doing with it.

Also it's unclear when the shady stuff (using customer money) started. Did they do that from the get-go? Or was it an act of desperation over the summer when crypto started to go south that they hoped would be temporary?