Elon Musk buys a big chunk of Twitter

-

.. -

The picture gets murkier as time goes on. The purchase may not happen at all.

-

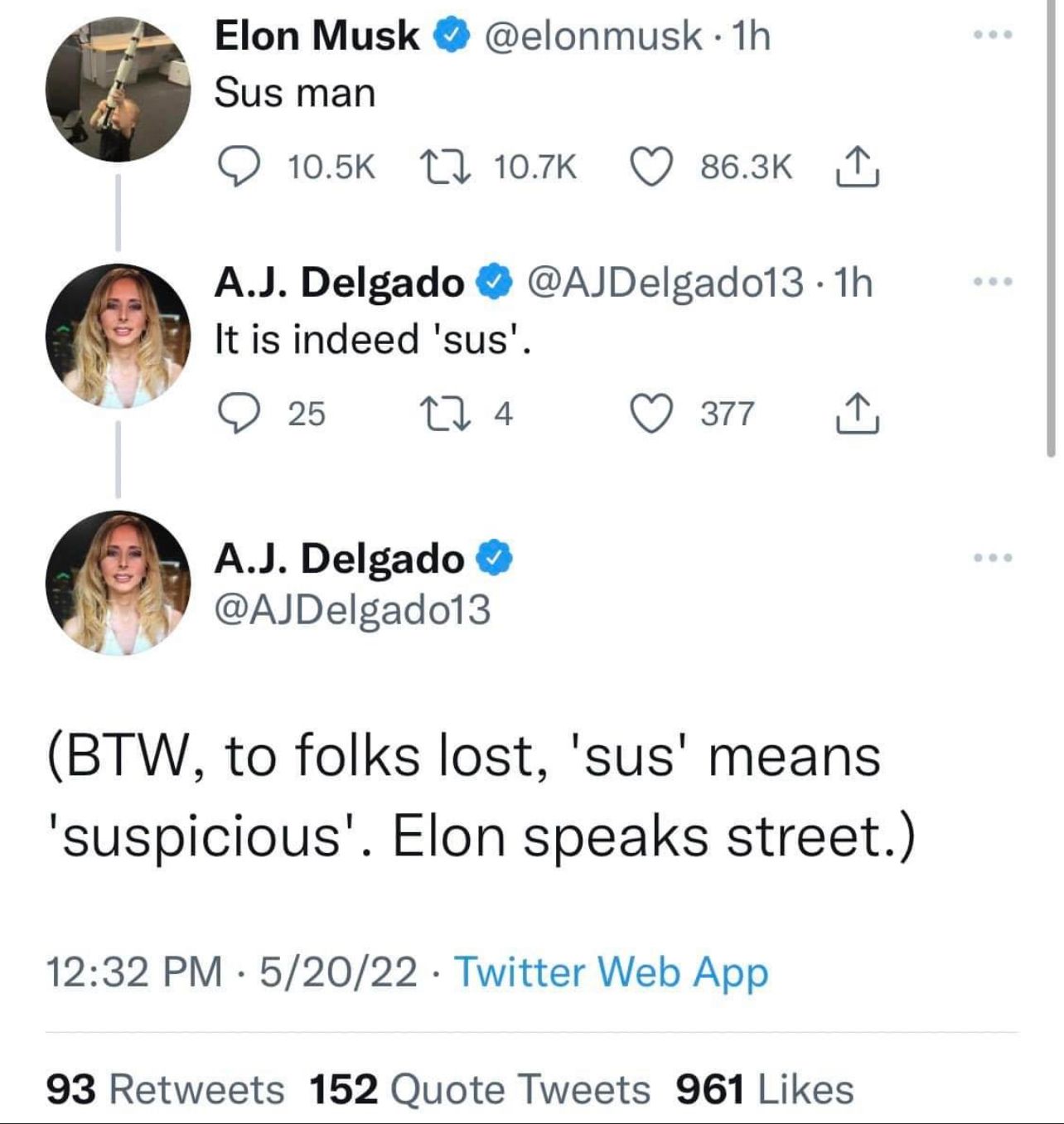

What does BTW mean?

I'm lost.

-

What does BTW mean?

I'm lost.

@Doctor-Phibes said in Elon Musk buys a big chunk of Twitter:

What does BTW mean?

I'm lost.

You've lost your way, gone right by you.

-

What does BTW mean?

I'm lost.

@Horace speaks street. Listen to him. LOL

-

Solid.

Actually, I think that might be 1950's hipster talk.

-

@jon-nyc said in Elon Musk buys a big chunk of Twitter:

Pass the popcorn, George.

I ate the popcorn a while ago.

Now, it's gone.

Tesla (TSLA.O) Chief Executive Officer Elon Musk said on Friday he was terminating his $44 billion deal for Twitter Inc (TWTR.N), citing material breach of multiple provisions of the agreement.

Shares of Twitter fell 6% in extended trading.

The announcement brings to an end a will-he-won’t-he saga after the world’s richest person clinched a deal for Twitter in April but then put the buyout on hold until the social media company proved that spam bots accounted for less than 5% of its total users.

-

To be sure he snuck out of the deal because the market tanked in the months following his bid and he was overpaying. He could still come back in a few weeks or months with a lower bid.

@jon-nyc said in Elon Musk buys a big chunk of Twitter:

To be sure he snuck out of the deal because the market tanked in the months following his bid and he was overpaying. He could still come back in a few weeks or months with a lower bid.

Yep. Overpaying, using a significantly reduced personal fortune.

-

@jon-nyc said in Elon Musk buys a big chunk of Twitter:

They have a colorable argument.

I wondered about that. His requirement that they disclose the number of "bot" or spam accounts occurred after his agreement to buy.

That might invalidate his claim.

-

On what planet is the ability for Musk to back out of this contract before closing, not unambiguously written into the contract? Well, this planet, but how?

@Horace said in Elon Musk buys a big chunk of Twitter:

On what planet is the ability for Musk to back out of this contract before closing, not unambiguously written into the contract?

YARLY.

One would think that the world's richest man would be able to hire the world's best lawyers.

-

On what planet is the ability for Musk to back out of this contract before closing, not unambiguously written into the contract? Well, this planet, but how?

@Horace said in Elon Musk buys a big chunk of Twitter:

On what planet is the ability for Musk to back out of this contract before closing, not unambiguously written into the contract? Well, this planet, but how?

In the world where every banker and securities lawyer knows that option premiums have value north of zero so don’t write free ones into contracts. In other words, this world.

)

)