Elon Musk buys a big chunk of Twitter

-

Bret Taylor

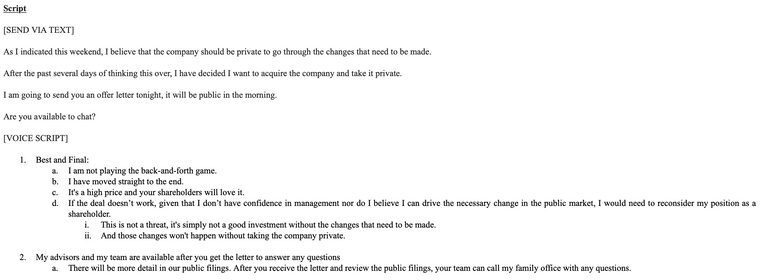

Chairman of the Board,I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

/s/ Elon Musk

-

@taiwan_girl said in Elon Musk buys a big chunk of Twitter:

If Elon Musk buys a large share of Twitter, what do you think he will do to change things?

Fewer bans. Wouldn't have banned Trump.

Other than that - not much.

Trump could have set up a simple blog called "Trump thoughts" and just self-published.

He was bigger than the platform.

@xenon said in Elon Musk buys a big chunk of Twitter:

Trump could have set up a simple blog called "Trump thoughts" and just self-published.

He used to publish short statements on and off via something he called “From the Desk of Donald J. Trump” (that’s after his Twitter and Facebook bans), but that did not get much traction and eventually he stopped doing that. None of Trump’s efforts to move to or create other social media platforms has gone anywhere.

-

As for Musk buying 100% of Twitter and taking Twitter private …

- Will the Board sell? @klaus aside, will the shareholders sell? The Twitter-verse has always been more than “making money,” just not sure how much more.

- Will it run into regulatory roadblocks? It won’t be the fist time the government step in to stop some mega merger or mega buyout.

- If the buyout attempt fails, will Musk try to build his own or just move on to the next project?

-

Why doesn't the stock price go up to $54.20? Is that a signal of the uncertainty that people will sell to Elon?

How many shareholders would need to sell to make the deal go through?

@Klaus said in Elon Musk buys a big chunk of Twitter:

Why doesn't the stock price go up to $54.20? Is that a signal of the uncertainty that people will sell to Elon?

How many shareholders would need to sell to make the deal go through?

Probably wait ‘til the US markets open before you take the last reported ticker price seriously?

-

Taking Musk’s statements at face value, the offer to buy Twitter will come up to $43 Billion. Subtracting the 9%-ish that Musk already owns, Musk still needs to cough up $40 Billion in cash. That’s something like one fifth of Musk’s estimated net worth, most of which are tied up in equities of other companies. Will Musk be willing to actually pay the massive capital gains hit to sell whatever equities in other companies to come up with the $40 Billion to take Twitter public? If he is, what are the effects on the companies whose stocks Musk will sell to raise the cash for his Twitter takeover?

-

Taking Musk’s statements at face value, the offer to buy Twitter will come up to $43 Billion. Subtracting the 9%-ish that Musk already owns, Musk still needs to cough up $40 Billion in cash. That’s something like one fifth of Musk’s estimated net worth, most of which are tied up in equities of other companies. Will Musk be willing to actually pay the massive capital gains hit to sell whatever equities in other companies to come up with the $40 Billion to take Twitter public? If he is, what are the effects on the companies whose stocks Musk will sell to raise the cash for his Twitter takeover?

@Axtremus said in Elon Musk buys a big chunk of Twitter:

Taking Musk’s statements at face value, the offer to buy Twitter will come up to $43 Billion. Subtracting the 9%-ish that Musk already owns, Musk still needs to cough up $40 Billion in cash. That’s something like one fifth of Musk’s estimated net worth, most of which are tied up in equities of other companies. Will Musk be willing to actually pay the massive capital gains hit to sell whatever equities in other companies to come up with the $40 Billion to take Twitter public? If he is, what are the effects on the companies whose stocks Musk will sell to raise the cash for his Twitter takeover?

Wouldn't banks happily give him a loan?

-

@Axtremus said in Elon Musk buys a big chunk of Twitter:

Taking Musk’s statements at face value, the offer to buy Twitter will come up to $43 Billion. Subtracting the 9%-ish that Musk already owns, Musk still needs to cough up $40 Billion in cash. That’s something like one fifth of Musk’s estimated net worth, most of which are tied up in equities of other companies. Will Musk be willing to actually pay the massive capital gains hit to sell whatever equities in other companies to come up with the $40 Billion to take Twitter public? If he is, what are the effects on the companies whose stocks Musk will sell to raise the cash for his Twitter takeover?

Wouldn't banks happily give him a loan?

@Klaus said in Elon Musk buys a big chunk of Twitter:

Wouldn't banks happily give him a loan?

The loan will need to be paid back, with interest. The money still needs to come from somewhere. With old school buyout, you’d try to convince the bank that the company you’re buying will generate enough cash to pay back the loan. Twitter is not even profitable right now.

-

@Klaus said in Elon Musk buys a big chunk of Twitter:

Wouldn't banks happily give him a loan?

The loan will need to be paid back, with interest. The money still needs to come from somewhere. With old school buyout, you’d try to convince the bank that the company you’re buying will generate enough cash to pay back the loan. Twitter is not even profitable right now.

@Axtremus said in Elon Musk buys a big chunk of Twitter:

@Klaus said in Elon Musk buys a big chunk of Twitter:

Wouldn't banks happily give him a loan?

The loan will need to be paid back, with interest. The money still needs to come from somewhere. With old school buyout, you’d try to convince the bank that the company you’re buying will generate enough cash to pay back the loan. Twitter is not even profitable right now.

He could use a part of his stocks in Tesla and SpaceX as collateral, no?

-

@Klaus said in Elon Musk buys a big chunk of Twitter:

Wouldn't banks happily give him a loan?

The loan will need to be paid back, with interest. The money still needs to come from somewhere. With old school buyout, you’d try to convince the bank that the company you’re buying will generate enough cash to pay back the loan. Twitter is not even profitable right now.

@Axtremus said in Elon Musk buys a big chunk of Twitter:

@Klaus said in Elon Musk buys a big chunk of Twitter:

Wouldn't banks happily give him a loan?

The loan will need to be paid back, with interest. The money still needs to come from somewhere. With old school buyout, you’d try to convince the bank that the company you’re buying will generate enough cash to pay back the loan. Twitter is not even profitable right now.

It’s not profitable because the God King doesn’t own it yet.

-

If it costs Musk 10% of his net worth, it would probably not change his life - at all. That's not the case for most of the planet.

What are the actual mechanics of this happening? Who has to approve the sale - board of directors or a vote of all shareholders?

If it's approved, I assume shareholders will be paid out at the price agreed upon, right?

So, if Twitter is not profitable, as @Axtremus says, how much money per year does it lose? Will that bother Musk, or will he just twirl his mustache and say, "I laugh at these losses! Watch what I do next!"?

-

How do you post gifs?

https://tenor.com/view/popcorns-crackhead-eating-popcorn-food-junk-gif-14546221

-

@Axtremus said in Elon Musk buys a big chunk of Twitter:

@Klaus said in Elon Musk buys a big chunk of Twitter:

Wouldn't banks happily give him a loan?

The loan will need to be paid back, with interest. The money still needs to come from somewhere. With old school buyout, you’d try to convince the bank that the company you’re buying will generate enough cash to pay back the loan. Twitter is not even profitable right now.

He could use a part of his stocks in Tesla and SpaceX as collateral, no?

@Klaus said in Elon Musk buys a big chunk of Twitter:

@Axtremus said in Elon Musk buys a big chunk of Twitter:

@Klaus said in Elon Musk buys a big chunk of Twitter:

Wouldn't banks happily give him a loan?

The loan will need to be paid back, with interest. The money still needs to come from somewhere. With old school buyout, you’d try to convince the bank that the company you’re buying will generate enough cash to pay back the loan. Twitter is not even profitable right now.

He could use a part of his stocks in Tesla and SpaceX as collateral, no?

Gets even more complicated once the other companies are brought into this deal. Yes, the stocks may be made collaterals, but you’d still need cash flow to service the loan. That shifts the argument to cash flow. SpaceX is still in the “hemorrhage money for R&D” phase. Tesla has positive cash flow but does not issue cash dividend. Musk still needs to go through a bunch of mechanisms to take money out of Tesla’s cash flow to service his (hypothetical) Twitter loan.