The Bitcoin/Crypto Thread

-

https://www.vox.com/the-goods/22922511/crypto-nfts-sports-betting-money-hobby

Money as a hobby.

"Why (mostly) 20- and 30-something dudes made crypto and sports betting their personality."

The wealth gap among holders of bitcoin is 100 times worse than the US economy: the top 0.01 percent control 27 percent of the 19 million bitcoin currently in circulation.

Not surprised, though probably the first time I see the crypto "wealth gap" called out.

-

https://www.vox.com/the-goods/22922511/crypto-nfts-sports-betting-money-hobby

Money as a hobby.

"Why (mostly) 20- and 30-something dudes made crypto and sports betting their personality."

The wealth gap among holders of bitcoin is 100 times worse than the US economy: the top 0.01 percent control 27 percent of the 19 million bitcoin currently in circulation.

Not surprised, though probably the first time I see the crypto "wealth gap" called out.

@axtremus said in The Bitcoin/Crypto Thread:

https://www.vox.com/the-goods/22922511/crypto-nfts-sports-betting-money-hobby

Money as a hobby.

"Why (mostly) 20- and 30-something dudes made crypto and sports betting their personality."

The wealth gap among holders of bitcoin is 100 times worse than the US economy: the top 0.01 percent control 27 percent of the 19 million bitcoin currently in circulation.

Not surprised, though probably the first time I see the crypto "wealth gap" called out.

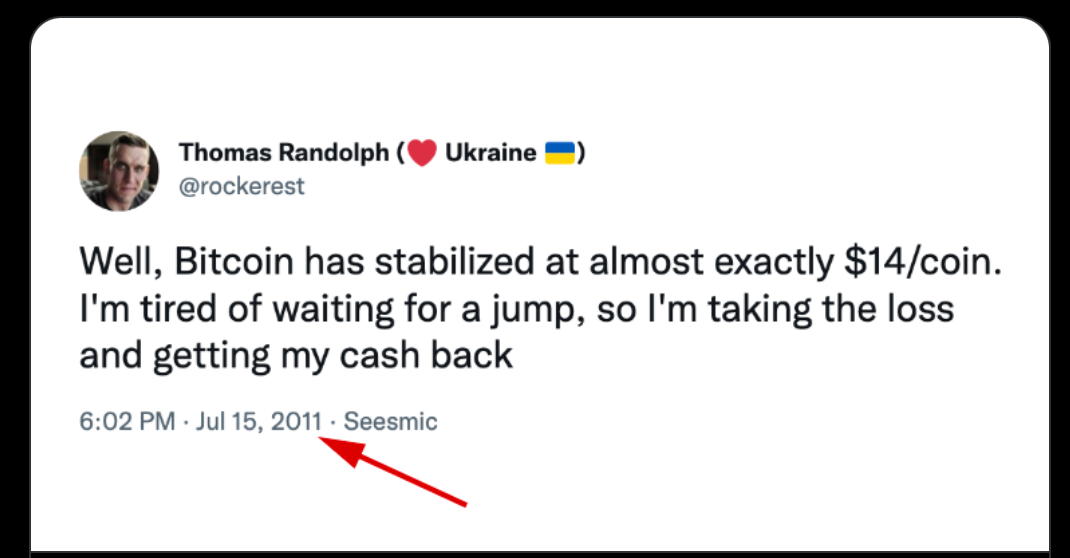

This feels timeless:

They seemed to work in tech or finance, mostly, and had come to connect with others over the thing they loved most in the world, the wild force driving the feeding frenzy of people storming the bouncer to get inside: money, and making it as quickly as possible

And some of these guys have been making insane amounts of money.

-

MoviePass 2.0, the idea is to let the users earn cryptocurrency by watching advertisements on their phone, the cryptocurrency can then be cashed in to watch movies in theaters. Proposal includes using the phone’s camera to track your eyeballs to make sure you’re actually watching the advertisements.

-

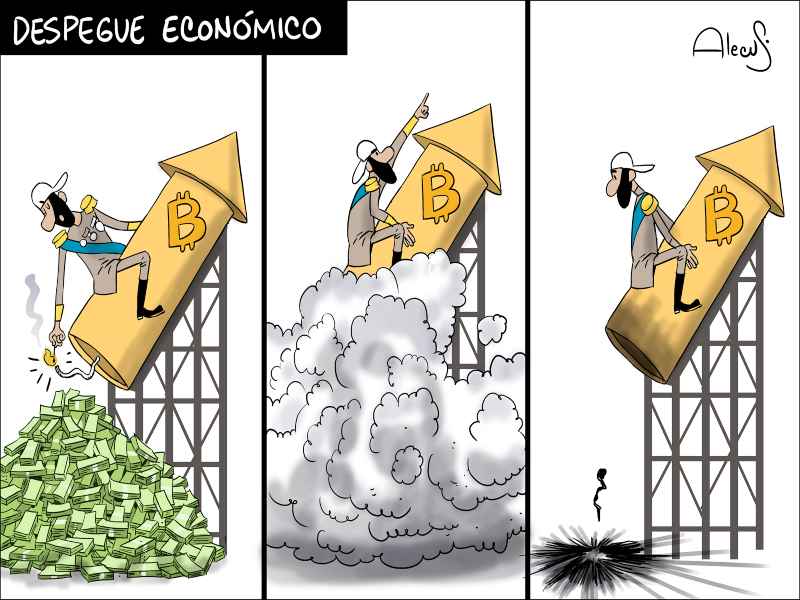

From: https://www.elsalvador.com/opinion/caricaturas/alecus/caricatura-de-alecus/897117/2021/

(credit: Alecus)I saw that cartoon while looking at https://blog.dshr.org/2022/02/ee380-talk.html

-

The Boston FED and MIT released their findings on initial research into a central bank digital currency (CBDC):

https://www.bostonfed.org/news-and-events/press-releases/2022/frbb-and-mit-open-cbdc-phase-one.aspx

The Federal Reserve Bank of Boston and the Digital Currency Initiative at the Massachusetts Institute of Technology today released the findings of their initial technological research into a central bank digital currency, or CBDC. The published research describes a theoretical high-performance and resilient transaction processor for a CBDC that was developed using open-source research software, OpenCBDC. This collaborative effort, known as Project Hamilton, focuses on technological experimentation and does not aim to create a usable CBDC for the United States. The research is separate from the Federal Reserve's Board's evaluation of the pros and cons of a CBDC.

…Project Hamilton (open-sourced): https://www.bostonfed.org/publications/one-time-pubs/project-hamilton-phase-1-executive-summary.aspx

-

This whole digital currency thing is confusing.

The central bank effort would be all about modernizing the payment system and creating some extra efficiency in the system. It would probably destroy some value for banks - but may create net benefit for Americans.

Even though it's called digital currency - it's very different from the likes of Bitcoin. That's about sidestepping the state altogether on the topic of currency.

These are very different things.

-

https://www.cnbc.com/2022/03/09/heres-whats-in-bidens-executive-order-on-crypto.html

Biden signed executive order on cryptocurrency.

-

QUOTE

U.S. President Joe Biden signed an executive order on Wednesday calling on the government to examine the risks and benefits of cryptocurrencies.

UNQUOTEWhy would this be an executive order? Seems kind of goofy. Would an executive order be needed to set up a team to look at this?

-

US Department of Labor basically says "no" on having crypto currency in a 401K plan.

-

https://www.cnn.com/2022/04/03/tech/axie-infinity-hack-party-nft-la/index.html

Crypto gaming platform, where the crypto assets that are supposedly backing the in-game currency got hacked, and the players now cannot convert their in-game currency back into trade-able crypto assets.

Also some unusual things about “digital serfdom” and “crypto Ponzi,” where a properly registered gamers can hire others (from low income communities) to play on their behalf, or to “rent out” their gaming credentials to others and split the earnings from playing the game.

-

-

I wonder how many levels deep you have to go under Biden before you reach the first person who has a clue about crypto.

@Horace said in The Bitcoin/Crypto Thread:

I wonder how many levels deep you have to go under Biden before you reach the first person who has a clue about crypto.

I am guessing four levels on the policy making side, three levels on the law enforcement side.

Policy making: POTUS, Treasury Secretary, head of some Crypto task force, some scientists/engineers on the task force who actually know crypto.

Law enforcement: POTUS, head of the Secret Service, head of some crypto crime investigative unit (who I expect is some one who has solid STEM background and understands enough about crypto currency to investigate crypto crimes)

-

I wonder how many levels deep you have to go under Biden before you reach the first person who has a clue about crypto.

@Horace said in The Bitcoin/Crypto Thread:

I wonder how many levels deep you have to go under Biden before you reach the first person who has a clue about crypto.

Gensler. I guess that’s technically one layer down but pretty far removed operationally from the WH.

And not at all involved in Biden’s exec order I’m sure. But it is the answer to the question

-

@Horace said in The Bitcoin/Crypto Thread:

I wonder how many levels deep you have to go under Biden before you reach the first person who has a clue about crypto.

Gensler. I guess that’s technically one layer down but pretty far removed operationally from the WH.

And not at all involved in Biden’s exec order I’m sure. But it is the answer to the question

@jon-nyc, re: “Gensler”

Thanks!

Per Wikipedia on Gary Gensler:

Gensler is … chair of the U.S. Securities and Exchange Commission … Co-Director of MIT’s Fintech@CSAIL and Senior Advisor to the MIT Media Lab Digital Currency Initiative.

That fits the bill and directly answers @Horace’s question.

A different, future SEC chair may not be similarly credentialed with regards to crypto currency. -

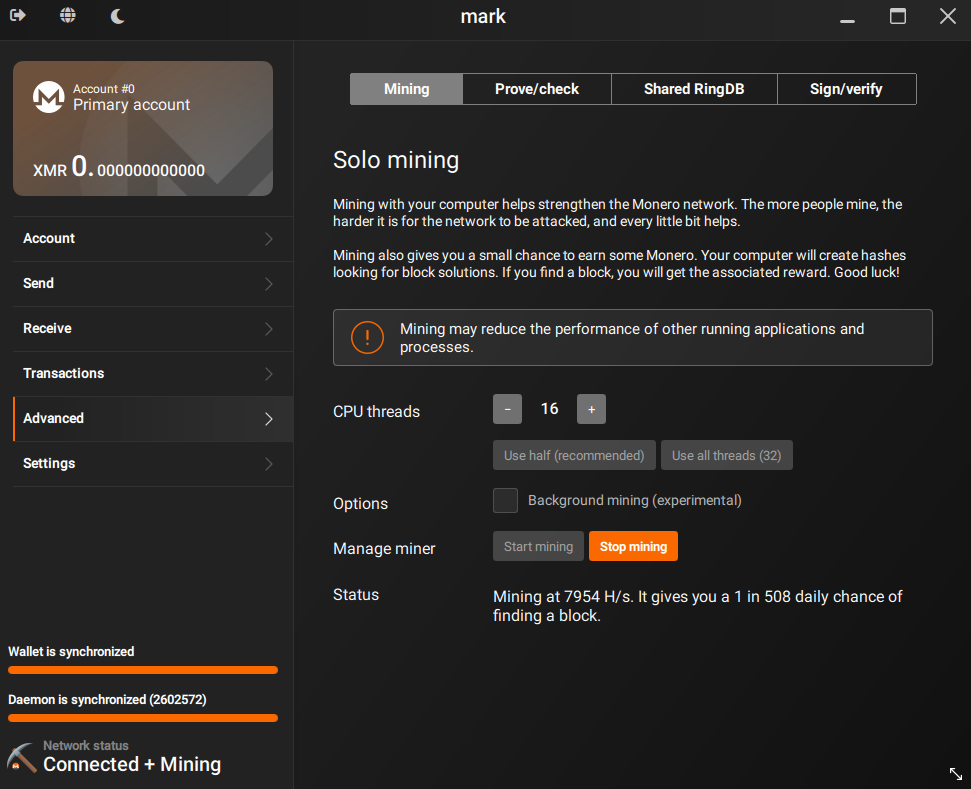

I am syncing the daemons and as soon as all 2.8 million blocks finish synchronizing, I will be ready to start mining Monero.

It's sitting at $234 or so down from a high of 500. It is projected to hit $1000 sometime mid 2020s

Going to put all these extra cores to work when I am not using them.

It's solo mining effort that does have pools but I am going solo. It does not permit ASICs to mine. It is meant for smaller and many CPU and GPU mining operations. I intend to get at least 3 machines in on the effort. 72 threads on off hours, probably 64 during work and 54 during gaming. All CPU based.

-

Mining for the first time. I might just build a solar powered mining rig. If you can get miners to run on solar, the profit margin jumps significantly.

Not sure how far down this rabbit hole I am going to venture, but, it will not just be dipping the toe that's for sure. lol

One report I read said that some people actually do win the BitCoin lottery on occasion using a simple USB stick ASIC miner. One person reportedly solo mined something like 6.5 bitcoin just a short time ago using a $2,500 miner. Made over $250k

Additional miners that look like WiFi access points are producing $30 per day and use very little power on the order or .30 per day.

A solar powered money tree is my goal.

There is one miner available that is producing $250+ per day 365 days per year. It costs a whopping $58k to buy one and the power requirements are pretty stiff but that $250 per day is profit. The payoff is 232 days of operation per miner. Imagine having 4 of them just mining away producing $300k+ of annual profit.

-

@mark are you better off mining bitcoin or a different currency?

I’ve been thinking about buying a moderate mining rig and having Lucas run it at college…