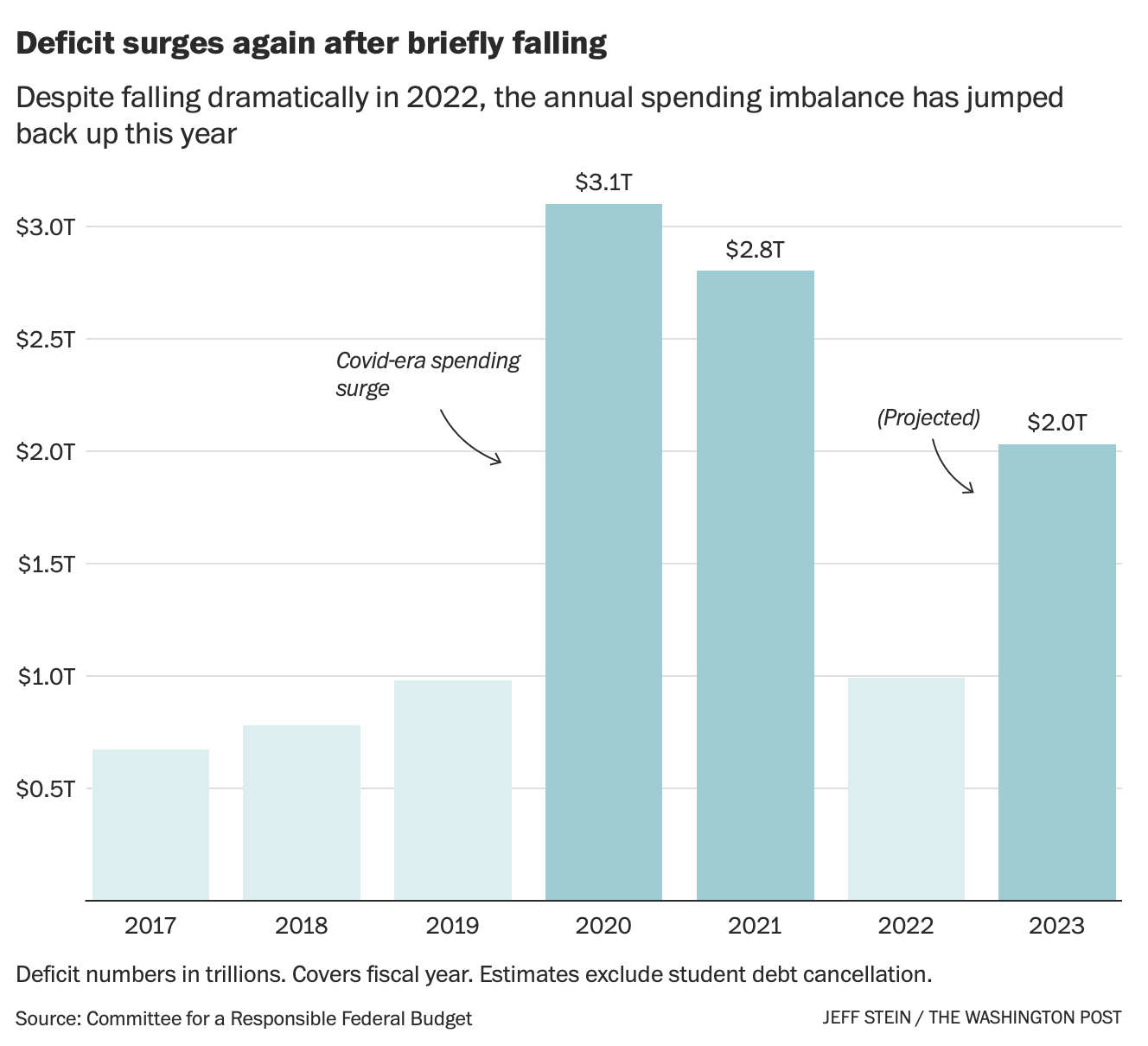

Bidenomics

-

-

The Washington Post...

https://www.washingtonpost.com/business/2023/09/03/us-debt-deficit-rises-interest-rate/

-

-

Just an opinion, but some things the GOP needs to run on...

- Biden economy vs. Trump economy. Before COVID, we were doing better than we had in years, with real wage gains and a rise in minority employment.

- Border security. More people get it, than last time.

- Military preparedness. Not just how much money we're spending, but what we are spending it on. Couple that with the woke ideology infecting the upper branches of the military.

- The Just-us Department. All Americans should live under the same rules and be afforded blind justice. I'd also pound the stump on all laws applying to all Americans. Including Congress. (Insert insider trading and Washington pols getting rich here).

- Abortion. The GOP is not getting the single-issue, under-40 female vote on this one. What they can do, is better explain the SCOTUS decision to the public. Then, they can run as anti-abortion or with a moderate position allowing early term (15 weeks?) abortion, but ultimately leaving it up to individual states.

- Climate change. One can agree that we are seeing some changes, but also point out that the science is not settled on why change is happening. And why many of the proposed and costly "remedies" may or may not work.

-

-

https://www.theguardian.com/business/2024/jan/19/us-economy-consumer-sentiment-rises

The S&P 500 recoded a new all-time high. The Guardian article attributes that to easing inflation expectations. Some also speculate that the Federal Reserve may start cutting interest rates.

-

San Francisco mall loses fifth store in a month as occupancy plunges to just 25%.

Home sales in 2023 were worst since 1995 as high mortgage rates slammed market.

Career coaches expecting 2024 layoff wave: Here’s what you should do.

Ford cutting F-150 Lightning truck production on weak demand.

Macy’s slashing over 2K jobs, closing five stores amid pressure to go private.

-

The TIME on Bidenomics, contrasting it with Reaganomics

https://time.com/6343967/bidenomics-is-real-economics/

…

Like Reaganomics before it, Bidenomics is largely an argument over economic cause and effect. Bidenomics argues that a large and thriving middle class is the primary cause of economic growth. “When the middle class does well, everybody does well,” the President has repeatedly explained. This is the core proposition of Bidenomics: that prosperity grows from the bottom up and the middle out.

.

Reaganomics, by contrast, argues that wealthy “job creators” are the primary cause of economic growth. “If we want job growth, we need to recognize who really creates jobs in America,” former House Speaker John Boehner memorably explained in a speech that lauded President Ronald Reagan for recognizing “that private sector job creators are the heart of our economy.” This is the core proposition of Reaganomics: that prosperity trickle’s down from the top.

.

This argument between Bidenomics and Reaganomics—between “middle-out” and “trickle-down”—reflects a fundamental disagreement over how market economies work with enormous implications for how we craft economic policy. Reaganomics argues that it is the availability of investment capital (that is, the money of the wealthy) that is the primary constraint on growth, and so it advances policies that focus on the needs of investors while trusting in the “invisible hand” of the market to fairly and efficiently distribute the benefits of any resulting growth. But Bidenomics understands that the only way to grow the economy is to fully include more people in it—as entrepreneurs, as innovators, as well-paid workers, and as robust consumers—and so it advances policies that intentionally focus on the needs of people, not money, while trusting in the dynamism of markets to innovate new solutions in response.

… -

The argument about growing the middle class is bs rhetoric based on everybody’s tendency to believe themselves middle class. The slow decline of the middle class is not because people are growing poorer, it’s the opposite. People are growing wealthier. The percentage of the population that falls in the definition of upper class or wealthy is the largest it’s ever been and is growing.

Beyond that, the definitions are skewed anyway. The lifestyle of the middle class approaches the lifestyle of the upper class. The lifestyle of the lower class approaches that of the perceived middle class.

-

The argument about growing the middle class is bs rhetoric based on everybody’s tendency to believe themselves middle class. The slow decline of the middle class is not because people are growing poorer, it’s the opposite. People are growing wealthier. The percentage of the population that falls in the definition of upper class or wealthy is the largest it’s ever been and is growing.

Beyond that, the definitions are skewed anyway. The lifestyle of the middle class approaches the lifestyle of the upper class. The lifestyle of the lower class approaches that of the perceived middle class.

@LuFins-Dad said in Bidenomics:

The argument about growing the middle class is bs rhetoric based on everybody’s tendency to believe themselves middle class. The slow decline of the middle class is not because people are growing poorer, it’s the opposite. People are growing wealthier. The percentage of the population that falls in the definition of upper class or wealthy is the largest it’s ever been and is growing.

So ... have you grown wealthier? Have you advanced beyond the "middle class" into the "upper class"?

-

Have you stopped eating boogers? From that experience can I extrapolate the prevalence of booger eating on a national level?

-

Krugman:

Our Economy Isn’t ‘Goldilocks.’ It’s Better.... [Fed Chair Jerome] Powell is clearly wrestling with a dilemma many countries wish they had: What’s the right monetary policy when the news is good on just about all fronts?

.

... We have an economy that is both piping hot (in terms of growth and job creation) and refreshingly cool (in terms of inflation).

...

First, inflation. For both historical and technical reasons, the Fed aims for 2 percent inflation; over the past six months, its preferred price measure has risen at an annual rate of … 2 percent. “Core” inflation, which excludes volatile food and energy prices, has been running slightly below target.

.

The Fed also looks at wage growth, not because workers have caused inflation, but because wages are usually the stickiest part of inflation and therefore an indicator of whether disinflation is sustainable. Well, on Wednesday, the Employment Cost Index came in below expectations and is now more or less consistent with the Fed’s target. On Thursday we learned that productivity has been rising rapidly, so unit labor costs are easily consistent with low inflation.

...

Finally, real G.D.P. grew a very solid 3.3 percent in the fourth quarter, making all those predictions of a 2023 recession look even sillier.

...

As typically happens when there’s a Democrat in the White House, the usual suspects are questioning the official data. But the strength of the job market and the fall in inflation are confirmed by many independent surveys of consumers and businesses.

.

So it has been good news all around. This is arguably the best economy we’ve had since the late 1990s.

...Conclusion:

This is a good economy.