"Not a single penny in additional federal tax."

-

@George-K said in "Not a single penny in additional federal tax.":

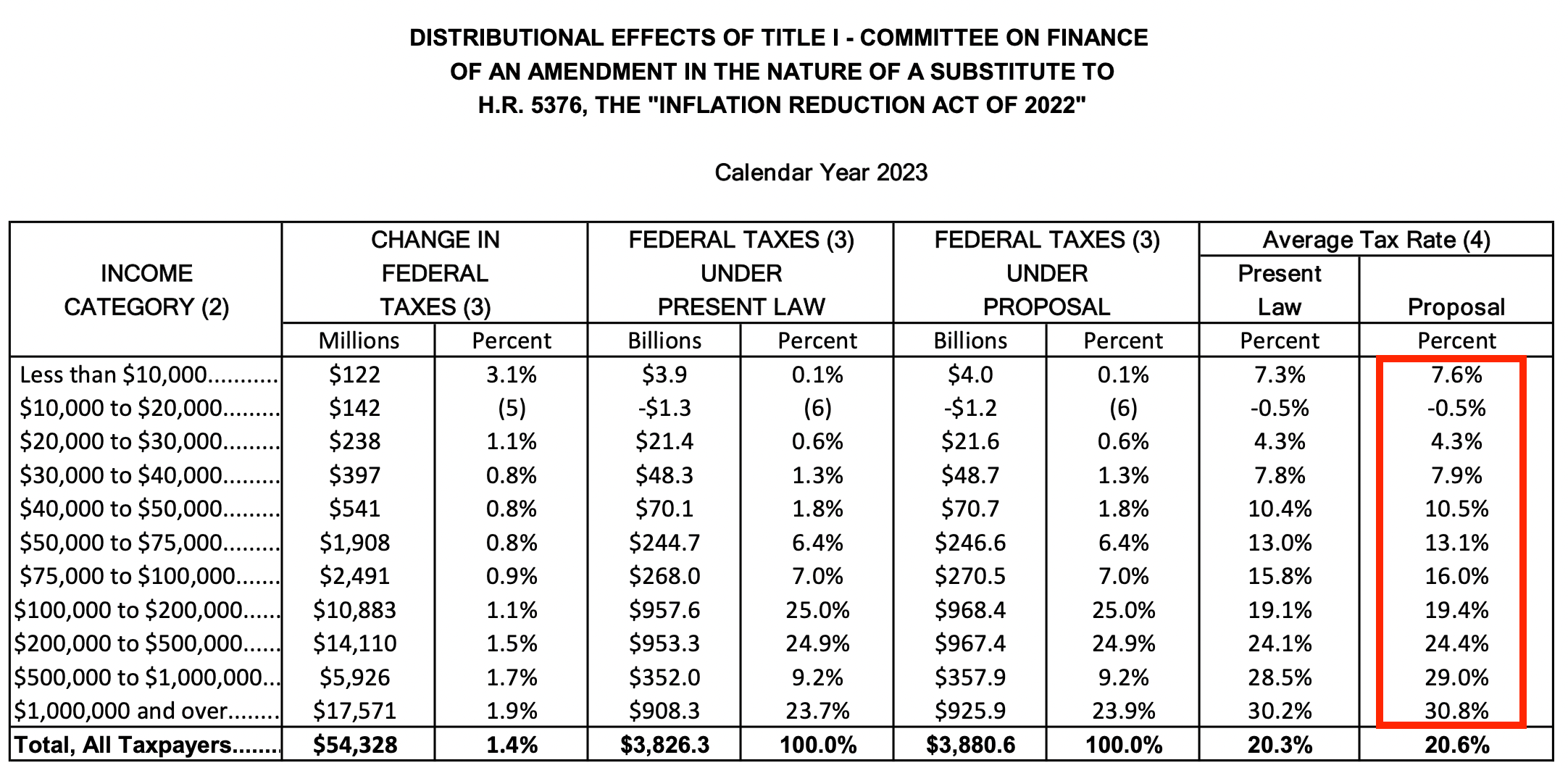

So, if you're "middle class" ($100-$200K), your taxes will go up 1.1%.

Did I read that right?

Probably Putin's price hike.

No, your taxes will go up .3%. The 1.1% is gross receipts to the Government…

@LuFins-Dad said in "Not a single penny in additional federal tax.":

No, your taxes will go up .3%. The 1.1% is gross receipts to the Government…

Duh....

Still more than "one penny," right?

-

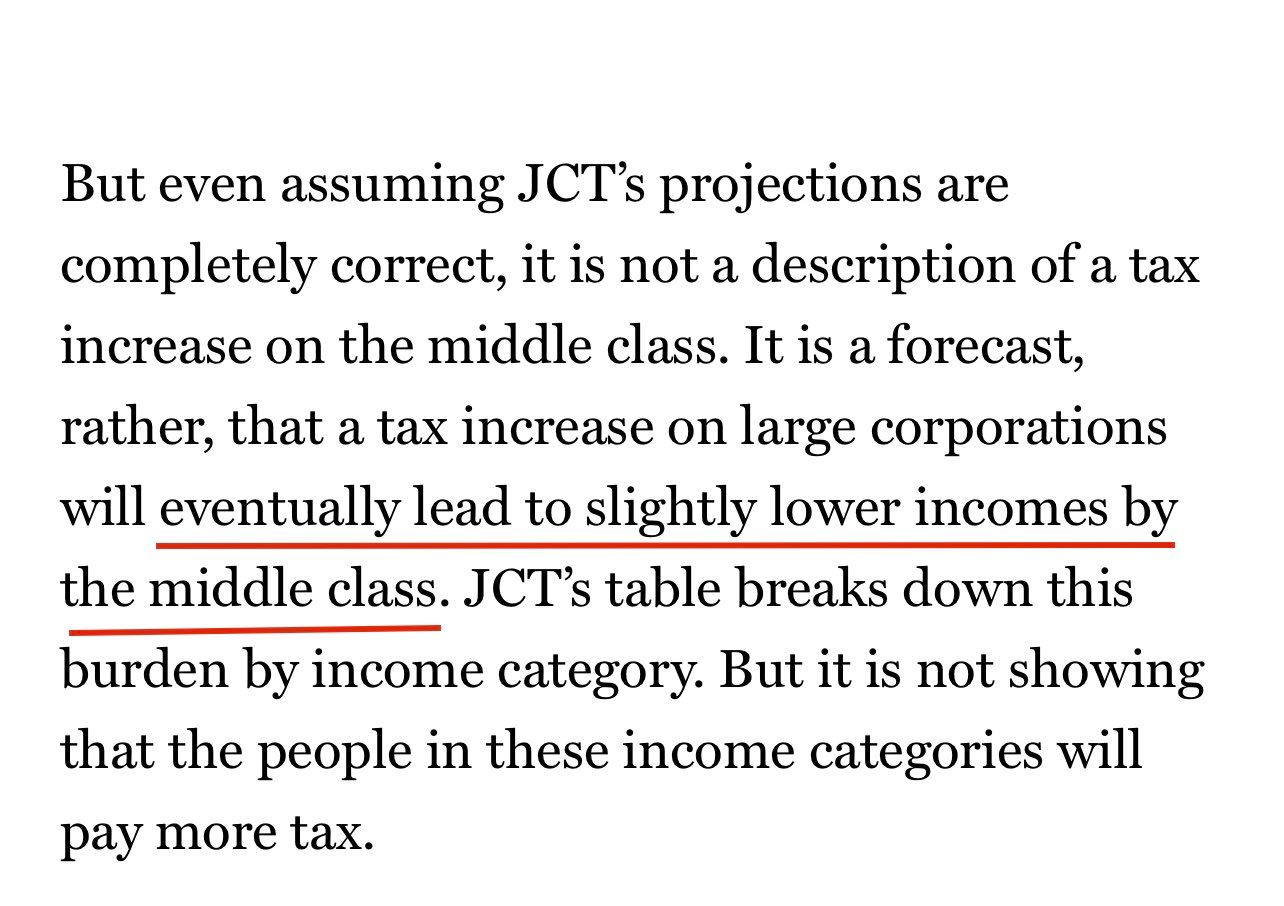

The new proposal does not increase tax rates for individuals, but have provisions for better IRS enforcement of tax laws. The “increases” in average individual rates you see are estimated improvement from better IRS enforcement — i.e., individuals who underreport or underpay taxes they legally owe are more likely to get caught, thus boosting federal receipts under the new proposal even when the legal tax rates for individuals stay the same as current law.

If you really want to knock Joe on “not a penny more” because some used-to-be tax cheaters will effective pay more due to better enforcement of tax laws, I suppose that is your prerogative. :man-shrugging:

-

I’m too lazy to check, but if what Ax wrote is true, then there is no tax increase, right?

-

BTW, doesn’t anyone like deficit reduction anymore?

When the 2017 tax reform was estimated to increase federal deficit by $1.5 Trillion, folks here (except myself) barely make a peep about it.

The “Inflation Reduction Act of 2022” is estimated to decrease federal deficit by $300 Billion, again no one here (except myself) acknowledges it.

It appears I have become the deficit hawk of TNCR.

-

@Jolly said in "Not a single penny in additional federal tax.":

See the Constitutional Convention thread...

Why? The Constitutional Convention has a nearly negligible probability of actually happening even if given years of time.

The tax reform in 2017 already happened and you failed to criticize its huge impact on increasing the deficit.

The “Inflation Reduction Act of 2022” is here now. If you are serious about deficit reduction at all, you can appreciate it now.

Wait … are you trying to kick the can down the road to some indefinite point in time in the future?

-

I’m too lazy to check, but if what Ax wrote is true, then there is no tax increase, right?

@Doctor-Phibes said in "Not a single penny in additional federal tax.":

if what Ax wrote is true

Since there is no source I'm sure we all agree that he just made it up.

-

@Jolly said in "Not a single penny in additional federal tax.":

See the Constitutional Convention thread...

Why? The Constitutional Convention has a nearly negligible probability of actually happening even if given years of time.

The tax reform in 2017 already happened and you failed to criticize its huge impact on increasing the deficit.

The “Inflation Reduction Act of 2022” is here now. If you are serious about deficit reduction at all, you can appreciate it now.

Wait … are you trying to kick the can down the road to some indefinite point in time in the future?

@Axtremus said in "Not a single penny in additional federal tax.":

@Jolly said in "Not a single penny in additional federal tax.":

See the Constitutional Convention thread...

Why? The Constitutional Convention has a nearly negligible probability of actually happening even if given years of time.

The tax reform in 2017 already happened and you failed to criticize its huge impact on increasing the deficit.

The “Inflation Reduction Act of 2022” is here now. If you are serious about deficit reduction at all, you can appreciate it now.

Wait … are you trying to kick the can down the road to some indefinite point in time in the future?

The 2017 tax reform was net neutral in terms of the deficit. Yes, the deficit increased but the deficit was already predicted to increase based on debt and interest coming due as well as increased in the SS and Medicare Rolls.

-

@Axtremus said in "Not a single penny in additional federal tax.":

@Jolly said in "Not a single penny in additional federal tax.":

See the Constitutional Convention thread...

Why? The Constitutional Convention has a nearly negligible probability of actually happening even if given years of time.

The tax reform in 2017 already happened and you failed to criticize its huge impact on increasing the deficit.

The “Inflation Reduction Act of 2022” is here now. If you are serious about deficit reduction at all, you can appreciate it now.

Wait … are you trying to kick the can down the road to some indefinite point in time in the future?

The 2017 tax reform was net neutral in terms of the deficit. Yes, the deficit increased but the deficit was already predicted to increase based on debt and interest coming due as well as increased in the SS and Medicare Rolls.

@LuFins-Dad said in "Not a single penny in additional federal tax.":

The 2017 tax reform was net neutral in terms of the deficit. Yes, the deficit increased but the deficit was already predicted to increase based on debt and interest coming due as well as increased in the SS and Medicare Rolls.

False. The CBO was very clear about this back in 2017:

...

The staff of the Joint Committee on Taxation (JCT) estimates that enacting the [2017 tax reform] legislation would reduce revenues by about $1,633 billion and decrease outlays by $219 billion over the 2018-2027 period, leading to an increase in the deficit of $1,414 billion over the next 10 years. ... -

@LuFins-Dad said in "Not a single penny in additional federal tax.":

The 2017 tax reform was net neutral in terms of the deficit. Yes, the deficit increased but the deficit was already predicted to increase based on debt and interest coming due as well as increased in the SS and Medicare Rolls.

False. The CBO was very clear about this back in 2017:

...

The staff of the Joint Committee on Taxation (JCT) estimates that enacting the [2017 tax reform] legislation would reduce revenues by about $1,633 billion and decrease outlays by $219 billion over the 2018-2027 period, leading to an increase in the deficit of $1,414 billion over the next 10 years. ...@Axtremus said in "Not a single penny in additional federal tax.":

@LuFins-Dad said in "Not a single penny in additional federal tax.":

The 2017 tax reform was net neutral in terms of the deficit. Yes, the deficit increased but the deficit was already predicted to increase based on debt and interest coming due as well as increased in the SS and Medicare Rolls.

False. The CBO was very clear about this back in 2017:

...

The staff of the Joint Committee on Taxation (JCT) estimates that enacting the [2017 tax reform] legislation would reduce revenues by about $1,633 billion and decrease outlays by $219 billion over the 2018-2027 period, leading to an increase in the deficit of $1,414 billion over the next 10 years. ...Their estimate... In the meantime, the actual deficit from 2017, 2018, and 2019 actually matched the CBO's projections from 2015...

-

@Axtremus said in "Not a single penny in additional federal tax.":

@LuFins-Dad said in "Not a single penny in additional federal tax.":

The 2017 tax reform was net neutral in terms of the deficit. Yes, the deficit increased but the deficit was already predicted to increase based on debt and interest coming due as well as increased in the SS and Medicare Rolls.

False. The CBO was very clear about this back in 2017:

...

The staff of the Joint Committee on Taxation (JCT) estimates that enacting the [2017 tax reform] legislation would reduce revenues by about $1,633 billion and decrease outlays by $219 billion over the 2018-2027 period, leading to an increase in the deficit of $1,414 billion over the next 10 years. ...Their estimate... In the meantime, the actual deficit from 2017, 2018, and 2019 actually matched the CBO's projections from 2015...

@LuFins-Dad said in "Not a single penny in additional federal tax.":

@Axtremus said in "Not a single penny in additional federal tax.":

@LuFins-Dad said in "Not a single penny in additional federal tax.":

The 2017 tax reform was net neutral in terms of the deficit. Yes, the deficit increased but the deficit was already predicted to increase based on debt and interest coming due as well as increased in the SS and Medicare Rolls.

False. The CBO was very clear about this back in 2017:

...

The staff of the Joint Committee on Taxation (JCT) estimates that enacting the [2017 tax reform] legislation would reduce revenues by about $1,633 billion and decrease outlays by $219 billion over the 2018-2027 period, leading to an increase in the deficit of $1,414 billion over the next 10 years. ...Their estimate... In the meantime, the actual deficit from 2017, 2018, and 2019 actually matched the CBO's projections from 2015...

A little hard to verify your claim when you don't cite sources or give specific definitions, but it still looks like you're wrong with that claim. To show that your claim is wrong, compare these:

-

https://www.cbo.gov/publication/50724 -- this old 2015 publication by the CBO projected at the time that the federal deficits to be no more than 3% of GDP between 2015 and 2019 each year.

-

https://fred.stlouisfed.org/series/FYFSGDA188S -- public data on actual federal deficits show that actual federal deficits have consistently exceeded 3% of GDP for the years 2017, 2018, and 2019.

-

-

You’re tying it into % of GDP. While I think the federal budget SHOULD be tied to GDP, it isn’t. But either way, we’re talking about revenue vs expenditure, not % of GDP…