Elon and the Bots

-

From Matt Levine's column today.

Oh Elon

In some parallel universe, Elon Musk’s dispute with Twitter Inc. is about how many bots there are on Twitter. In that universe, Twitter’s merger agreement with Musk contains a representation that no more than 5% of Twitter’s monetizable daily active users, or mDAUs, are bots, Musk’s obligation to close the merger is contingent on this representation being true, and Musk has discovered that it is wrong. Therefore he is able to walk away from the agreement, and maybe even sue Twitter for damages for misleading him.

In our actual universe none of this is true. In the real world, Musk signed a merger agreement with Twitter, and it was publicly filed, and you can read it here. That merger agreement does not mention bots at all. In pursuing and signing this deal, Musk was excited about “defeating” the bots, sure, but he didn’t care how many there were. (The more of them there are, the more glory in defeating them.) He did not do any due diligence on the number of bots before signing the agreement, nor did he ask Twitter to make any promises about how many bots there were. Nothing in the negotiations over the deal, or in the merger agreement itself, was in any way contingent on anything at all about bots.

Now, even in the real world, the merger agreement does contain a representation that none of Twitter’s filings with the US Securities and Exchange Commission “contained any untrue statement of a material fact.” And if that representation is false enough to have a “material adverse effect” on Twitter, then Musk can get out of the deal.

And Twitter’s SEC filings do mention bots. But they don’t contain any promises that no more than 5% of Twitter’s users are bots. These filings are also public, and you can also read them. Here is what they say about bots:

There are a number of false or spam accounts in existence on our platform. We have performed an internal review of a sample of accounts and estimate that the average of false or spam accounts during the first quarter of 2022 represented fewer than 5% of our mDAU during the quarter. The false or spam accounts for a period represents the average of false or spam accounts in the samples during each monthly analysis period during the quarter. In making this determination, we applied significant judgment, so our estimation of false or spam accounts may not accurately represent the actual number of such accounts, and the actual number of false or spam accounts could be higher than we have estimated.

Let’s pick out the factual assertions in that paragraph:

- There are “false or spam accounts” on Twitter.

- Twitter reviews some sample accounts each month.

- It estimates, based on that review, that the bots (false or spam accounts) are fewer than 5% of mDAUs.

- That estimate is based on the “average of false or spam accounts in the samples.”

- That estimate, and the labeling of spam accounts, is subjective; Twitter “applied significant judgment” to reach it.

- “The actual number of false or spam accounts could be higher than we have estimated.”

You could imagine how some of those statements could be false. If Twitter did not review any sample accounts — if it just made up the 5% number and put it in the filings — then its SEC filings would be false. If it reviewed its samples and labeled 25% of them spam, and then wrote 5% in the filings anyway, then the filings would be false.

On the other hand. If you said to Twitter “look, I don’t like how you sample accounts, and I really don’t like how you evaluate them for spam. I have developed a better way to identify spam accounts, and when I apply my method to a different sample I conclude that 8% of your mDAUs are spam,” and Twitter looked at your method and said “oh, wow, you know what, you are entirely right in every respect, this is better, 8% of our mDAUs are spam” — then nothing in Twitter’s SEC filings would be false. (I suppose they’d have to write something different in future filings.) The filings said that their numbers were estimates, that they applied significant judgment, and that the actual number might be higher. If you said “I have a better estimate with better judgment, and the numbers are higher,” they could reasonably respond “yes, right, exactly like we said.”

...

Elon Musk is trying to get out of his deal to buy Twitter. He claims to believe that more than 5% of Twitter’s mDAUs are bots. It would clearly be advantageous for Musk if we lived in the alternate universe where Twitter’s merger agreement promised that no more than 5% of its mDAUs were bots. For one thing, he might be right, and then he could get out of the deal. He has never produced even a hint of any evidence that he might be right, but never mind! In any case there could be a complicated factual dispute: Twitter could argue for its numbers and its methodology, and Musk could argue for different numbers using a different methodology, and it would be fairly easy to muddy the waters and create the impression that Musk could be right. Musk is good at muddying waters and impressing the impressionable, and this would play to his strengths. Whereas in the real world, where Twitter did not promise Musk that fewer than 5% of mDAUs are bots, it is much harder for Musk to make any argument at all that he can get out of his deal.

-

He goes on to point out that Musk's filings alone concede the truth of the Twitter filings.

On Friday, Musk’s lawyers filed a document in the Delaware Chancery Court opposing Twitter’s motion to have a quick trial in September on Musk’s efforts to get out of the deal. This document is forceful and well-done,[1] but it exists in that alternate universe where Twitter promised that no more than 5% of its mDAUs are spam bots and Musk agreed to buy Twitter in reliance on that promise. “Twitter also represents that no more than 5% of these accounts in a given quarter consist of false or spam accounts,” say Musk’s lawyers, even though, as I have just explained in incredibly boring detail, Twitter does not say that at all anywhere.

In Musk’s universe, (1) Twitter promised him that fewer than 5% of mDAUs are bots, (2) he believed them when he signed the deal, (3) he stopped believing them and asked for proof, and (4) they stonewalled him instead of providing proof. But if you just look at what the merger agreement and the SEC filings actually say, the whole thing is nonsense. Musk’s lawyers say:

In a May 6 meeting with Twitter executives, Musk was flabbergasted to learn just how meager Twitter’s process was. Human reviewers randomly sampled 100 accounts per day (less than 0.00005% of daily users) and applied unidentified standards to somehow conclude every quarter for nearly three years that fewer than 5% of Twitter users were false or spam. That’s it. No automation, no AI, no machine learning.

And again (citations omitted):

Thus, on May 6, 2022, Musk met with Twitter’s leadership, including its CEO and CFO to discuss, among other items, how Twitter calculates its spam population.

Musk was stunned to discover that Twitter’s process for identifying spam accounts relied on human reviewers to eyeball a minuscule portion of the userbase rather than utilizing the company’s machine learning capabilities. Musk quickly understood that management did not have a handle on the bot and spam issue.

But this concedes the whole ballgame! Just from reading this, you know that:

Every sentence about bots in Twitter’s SEC filings is true. Twitter does in fact estimate the bot numbers by sampling some accounts (“a minuscule portion of the userbase”) and applying judgment (“relied on human reviewers to eyeball”) to determine which of them are bots, and then uses the average number of bots in its samples to estimate the total number of bots. That estimate is under 5%. There are no misrepresentations about bots in the SEC filings, which accurately describe the process that Twitter explained to Musk and that Musk believes Twitter follows. There are no misrepresentations about bots in the merger agreement, because there are no representations about bots at all in the merger agreement.

Musk asked for information about how Twitter calculates its bot numbers, and Twitter gave him the information he needed. Musk knows exactly how Twitter calculates its bot numbers! So do you! It is set out in that quote from Musk’s lawyers. He just doesn’t like it. So he followed up by asking for tons and tons of data to do his own calculations, and Twitter gave him some but not all of what he asked for. But this data was totally irrelevant both to Twitter’s representations (which were true) and to closing the deal (because Musk is trying not to close the deal), so Twitter had no obligation to give it to him. -

@Klaus said in Elon and the Bots:

So, how will this end? Feel free to speculate!

One of three ways:

-

Twitter gets its request for specific performance and Elon is forced to buy

-

Judge denies specific performance since damages can be paid monetarily, and comes up with a method for determining how many billions of dollars Musk owes Twitter. But it would be north of 10B for sure.

-

the judge denies specific request and forces Twitter to accept the 1B break up fee.

I think the third option is the least likely. Perhaps Musk loses his bid to get the trail delayed and will realize he’s on track to lose. Then they negotiate an 11-figure break up fee.

-

-

@Klaus said in Elon and the Bots:

So, how will this end?

With a rather embarrassing temper tantrum, some obnoxious Tweeting, and the withdrawal or banning of a Twitter account.

A bit like the last election, IOW.

-

$1 Billion dollar break-up fee at worst if that is what was detailed in the pre-nup.

-

@Klaus said in Elon and the Bots:

So, how will this end? Feel free to speculate!

One of three ways:

-

Twitter gets its request for specific performance and Elon is forced to buy

-

Judge denies specific performance since damages can be paid monetarily, and comes up with a method for determining how many billions of dollars Musk owes Twitter. But it would be north of 10B for sure.

-

the judge denies specific request and forces Twitter to accept the 1B break up fee.

I think the third option is the least likely. Perhaps Musk loses his bid to get the trail delayed and will realize he’s on track to lose. Then they negotiate an 11-figure break up fee.

@jon-nyc said in Elon and the Bots:

I think the third option is the least likely. Perhaps Musk loses his bid to get the trail delayed and will realize he’s on track to lose. Then they negotiate an 11-figure break up fee.

Hm, but then it would be cheaper to buy Twitter and sell it again after a while.

-

-

I don't see how he can be forced to purchase the company. If all deals were final upon an MOU or a written acceptance of an offer, then all of the other closing paperwork and such would be unnecessary and completely irrelevant. And certainly, a "break up fee" would be irrelevant and unnecessary. The very existence of the break-up fee indicates that the sale is not final.

The break-up fee represents the absolute most that Musk should be held responsible for paying, and from here it should be a question of whether he owes all of it or none of it...

-

The deal isn’t worded that way at all. He doesn’t have a billion dollar option to end the deal. The contract was very seller friendly which musk thought of as a selling point back in April.

The deal calls for specific performance as the remedy except in the rarest of contingencies which never came to pass. But that’s so unusual that the judge might award monetary damages instead.

There’s a newish advisory opinions podcast on the subject as well as an episode of Ken White’s new podcast.

-

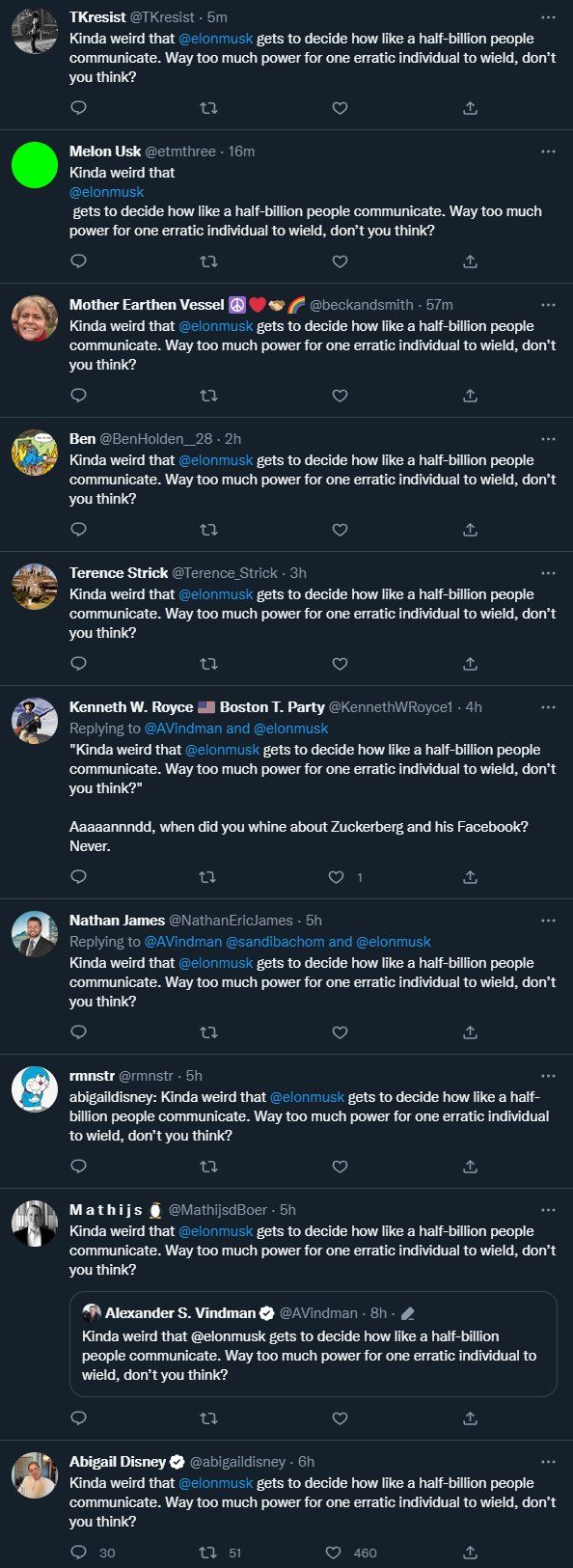

Odd thing I’ve noticed.

The people (and publications) who got the most pleasure out of the idea of Musk buying Twitter are the most eager to support his decision to try to back out.

It seems weird at first glance - if you want Musk to own Twitter, wouldn’t you route for twitters court case?

It only makes sense if you see it through a tribal lens. Musk good, Twitter bad. Support our guy is the motivation.

-

Odd thing I’ve noticed.

The people (and publications) who got the most pleasure out of the idea of Musk buying Twitter are the most eager to support his decision to try to back out.

It seems weird at first glance - if you want Musk to own Twitter, wouldn’t you route for twitters court case?

It only makes sense if you see it through a tribal lens. Musk good, Twitter bad. Support our guy is the motivation.

@jon-nyc said in Elon and the Bots:

Odd thing I’ve noticed.

The people (and publications) who got the most pleasure out of the idea of Musk buying Twitter are the most eager to support his decision to try to back out.

It seems weird at first glance - if you want Musk to own Twitter, wouldn’t you route for twitters court case?

It only makes sense if you see it through a tribal lens. Musk good, Twitter bad. Support our guy is the motivation.

Nope… I have no particular love for either. I do enjoy the spectacle, though.

-

Odd thing I’ve noticed.

The people (and publications) who got the most pleasure out of the idea of Musk buying Twitter are the most eager to support his decision to try to back out.

It seems weird at first glance - if you want Musk to own Twitter, wouldn’t you route for twitters court case?

It only makes sense if you see it through a tribal lens. Musk good, Twitter bad. Support our guy is the motivation.

@jon-nyc said in Elon and the Bots:

Odd thing I’ve noticed.

The people (and publications) who got the most pleasure out of the idea of Musk buying Twitter are the most eager to support his decision to try to back out.

It seems weird at first glance - if you want Musk to own Twitter, wouldn’t you route for twitters court case?

It only makes sense if you see it through a tribal lens. Musk good, Twitter bad. Support our guy is the motivation.

If we can record these instances of human tribal thought patterns, the preponderance of evidence will someday allow us to believe objectively that tribalism exists.

-

Personally I’m hoping the contract prevails, whatever the contract is, and I hoped he would buy Twitter, but no longer find that likely. I can only imagine which tribe that pigeonholes me into. Probably those who reflexively and thoughtlessly hoped that Musk would buy Twitter, and that the contract would prevail, whatever the contract is, but no longer find the purchase likely. Typical.

-

At what point do we see somebody suggest a constitutional amendment to allow Musk to be President?

That would be hilarious.

-

At what point do we see somebody suggest a constitutional amendment to allow Musk to be President?

That would be hilarious.

@Doctor-Phibes said in Elon and the Bots:

At what point do we see somebody suggest a constitutional amendment to allow Musk to be President?

That would be hilarious.

The easier solution would be to make him God Emperor. That gets past the whole Constitution thing…

-

@Doctor-Phibes said in Elon and the Bots:

At what point do we see somebody suggest a constitutional amendment to allow Musk to be President?

That would be hilarious.

The easier solution would be to make him God Emperor. That gets past the whole Constitution thing…

@LuFins-Dad said in Elon and the Bots:

@Doctor-Phibes said in Elon and the Bots:

At what point do we see somebody suggest a constitutional amendment to allow Musk to be President?

That would be hilarious.

The easier solution would be to make him God Emperor. That gets past the whole Constitution thing…

Cod Emperor, more like. He's well fishy.