Inflation to be "Extraordinarily Elevated" due to Putin's price hike.

-

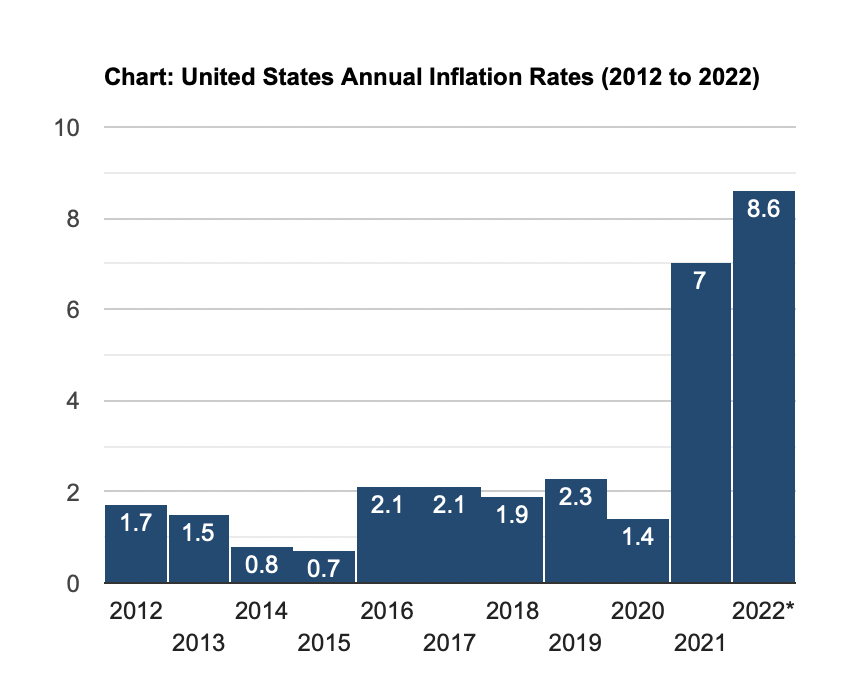

See, April's inflation numbers are slightly better than March's.

Will May's numbers be worse or better? Too soon to tell right now. Energy / gas prices are up, supply chain issues from China getting worse and cascading closer to consumers, so May does not look optimistic.

-

See, April's inflation numbers are slightly better than March's.

Will May's numbers be worse or better? Too soon to tell right now. Energy / gas prices are up, supply chain issues from China getting worse and cascading closer to consumers, so May does not look optimistic.

@Axtremus said in Inflation to be "Extraordinarily Elevated" due to Putin's price hike.:

See, April's inflation numbers are slightly better than March's.

Will May's numbers be worse or better? Too soon to tell right now. Energy / gas prices are up, supply chain issues from China getting worse and cascading closer to consumers, so May does not look optimistic.

How the everloving hell do you see that as an improvement? The rate of increase was slightly less, but it still increased…

-

-

@Axtremus said in Inflation to be "Extraordinarily Elevated" due to Putin's price hike.:

See, April's inflation numbers are slightly better than March's.

Will May's numbers be worse or better? Too soon to tell right now. Energy / gas prices are up, supply chain issues from China getting worse and cascading closer to consumers, so May does not look optimistic.

How the everloving hell do you see that as an improvement? The rate of increase was slightly less, but it still increased…

@LuFins-Dad said in Inflation to be "Extraordinarily Elevated" due to Putin's price hike.:

How the everloving hell do you see that as an improvement? The rate of increase was slightly less, but it still increased…

The percentage figures are “year over year” comparisons.

-

@Jolly said in Inflation to be "Extraordinarily Elevated" due to Putin's price hike.:

How many average people will ever see that graph?

Doesn't matter. I should've posted that in the "Biden's Lies" thread.

All the average joe will see is increase in prices on pretty much everything, and a real-world decrease of about 3% in his purchasing power.

Graphs are irrelevantIt's the economy, stupid. -

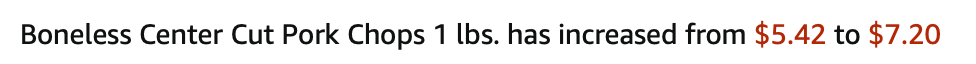

I do the grocery shopping at my house. I'm not a coupon clipper, but I'm a very aggressive shopper ( I stopped at three stores for loss leaders Thursday). I'd say most stuff is up between 10-20%, with shrinkflation on many products.

BTW, among other things, I bought 4 chuck roasts for $3.47/lb, 10 pounds chicken leg quarters ( I cut them up) for $0.39/lb, Jimmy Dean sausage for $2.47/lb, bananas for $.029/lb, strawberries for $2.49/quart, eggs for $1.25/dozen, canned Cokes for $2.77/12 pack.

I shop.

-

I do the grocery shopping at my house. I'm not a coupon clipper, but I'm a very aggressive shopper ( I stopped at three stores for loss leaders Thursday). I'd say most stuff is up between 10-20%, with shrinkflation on many products.

BTW, among other things, I bought 4 chuck roasts for $3.47/lb, 10 pounds chicken leg quarters ( I cut them up) for $0.39/lb, Jimmy Dean sausage for $2.47/lb, bananas for $.029/lb, strawberries for $2.49/quart, eggs for $1.25/dozen, canned Cokes for $2.77/12 pack.

I shop.

@Jolly said in Inflation to be "Extraordinarily Elevated" due to Putin's price hike.:

I do the grocery shopping at my house. I'm not a coupon clipper, but I'm a very aggressive shopper ( I stopped at three stores for loss leaders Thursday). I'd say most stuff is up between 10-20%, with shrinkflation on many products.

BTW, among other things, I bought 4 chuck roasts for $3.47/lb, 10 pounds chicken leg quarters ( I cut them up) for $0.39/lb, Jimmy Dean sausage for $2.47/lb, bananas for $.029/lb, strawberries for $2.49/quart, eggs for $1.25/dozen, canned Cokes for $2.77/12 pack.

I shop.

Me too. And I buy in quantity if the deal is good enough.

-

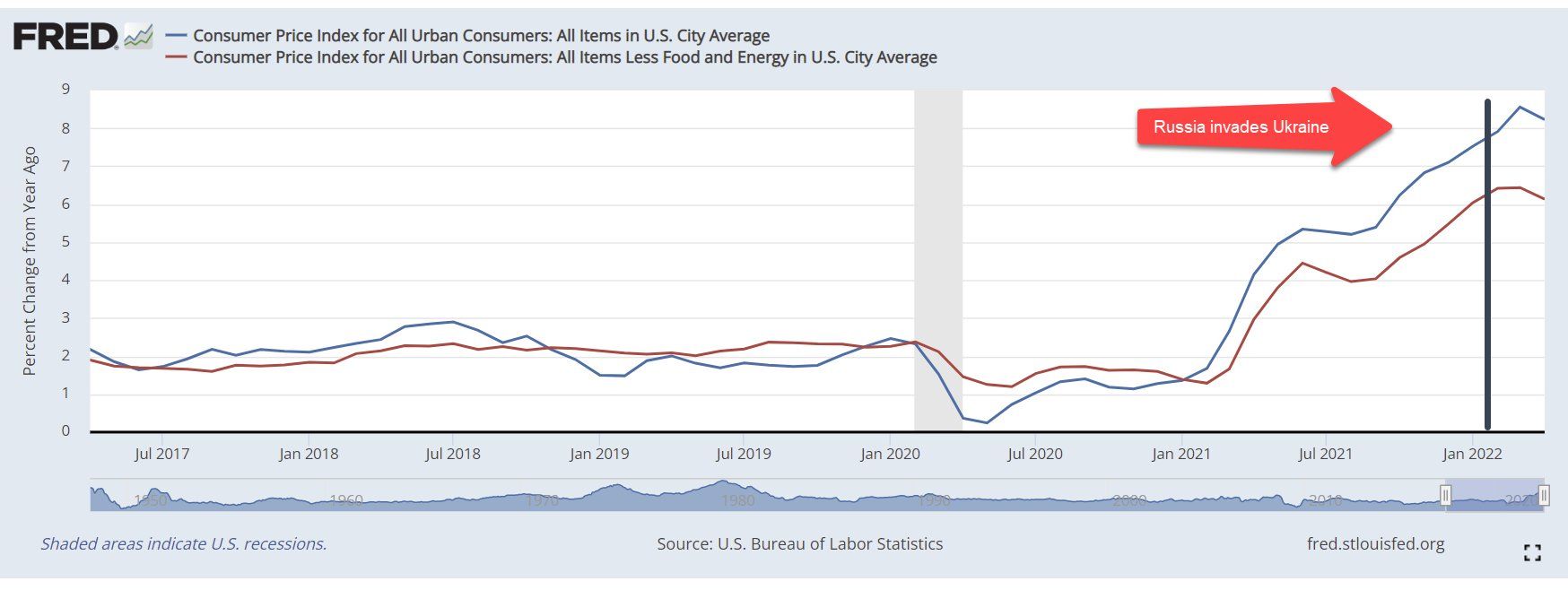

High inflation is a downside of strong U.S. growth, fueled in part by low interest rates and government stimulus to counter the Covid-19 pandemic’s impact. The annual rate of inflation has risen sharply since early 2021, when the U.S. economy’s rebound from the pandemic accelerated, leading to supply disruptions and other imbalances that put upward pressure on prices for longer than policy makers anticipated.

The Federal Reserve faces the difficult task of tightening monetary policy enough to cool the economy and calm inflation, while avoiding a recession. Fed officials on May 4 lifted rates by a half-percentage point and will meet again next week to consider a similar increase.

Economists and policy makers are watching closely for signs that inflationary pressures are ebbing. The continued rapid pace of price increases adds pressure on the Fed to raise rates aggressively to tame inflation.

“The big picture is that inflation remains very stubborn and will continue to be very slow to recede,” said Sarah House, senior economist at Wells Fargo Securities. “With what we see in energy markets in the past few weeks, we are unlikely to have seen the peak in inflation this cycle yet.”

Energy prices rose in May as Russia’s invasion of Ukraine continued to push up prices for crude-oil and natural gas. Gasoline prices have breached record levels in recent weeks, with the average gallon of regular unleaded currently going for $4.97, according to AAA. The strength in energy price rises will keep putting upward pressure on inflation, said Ms. House.

“Given everything from the implications of the Russian invasion of Ukraine, the Chinese lockdowns and just the sheer appetite for travel…what we’ve seen is the perfect storm of those factors hitting, along with some major refinery closures,” she said.

Consumers’ grocery bills have risen by an annual rate of more than 10% since earlier this year, a pace last seen in the early 1980s. Food prices are up broadly, unlike early in the pandemic when meat prices drove much of the increase, said Paul Ashworth, chief North America economist at Capital Economics.

“It’s not just the weather—it’s diseases affecting citrus trees and chickens. It’s the Ukraine conflict,” which has affected prices for baked goods and cereals, he said.

“For people on lower incomes this is not discretionary spending,” Mr. Ashworth said. “Other than substituting out cheaper food types—cheaper meat cuts, whatever it might be—people need to continue buying food.”

Price pressures are strong across much of the economy in part because of an unusually tight U.S. labor market, with demand for workers outstripping supply. Employers added 390,000 jobs last month, and the unemployment rate hovered near a half-century low. Still, even after the economy gained more than 6.5 million jobs in the space of a year, fewer Americans are employed as a share of the population than before the pandemic.

Those dynamics are driving wage growth, adding to inflationary pressures. Strong gains in wages and hiring are pumping more money into Americans’ bank accounts, propping up demand as inflation erodes spending power for many. Meanwhile, higher labor costs stemming from worker shortages are prompting many employers to raise prices.

Demand for travel and other services has surged as the impact of Covid-19 recedes, pushing up prices for airline fares, hotels and dining.

Despite strong demand for summer activities such as travel, higher prices are eating into many business owners’ profitability. In early 2020, Suzanne Hoffman, an author who runs wine tours in Italy, canceled group tours to Piedmont because of the pandemic. A number of guests rolled over their deposits and are finally taking their trips this summer.

“The demand is there; people are just chomping at the bit,” said Ms. Hoffman, who is based in Edwards, Colo.

But the people taking those long-delayed trips are paying 2019 prices, she said, while fuel, dining and other costs to conduct the tours have gone up. That is hurting Ms. Hoffman’s bottom line to the extent that she might stop running future tours given the uncertain outlook.

“I canceled my October tour. I just don’t want to make any commitments beyond this summer,” she said.

Some main drivers of inflation could be easing. The edge has come off used-car prices in recent months—prices in April were down 4.4% from January following a rapid run up in costs—as auto production has gradually picked up.

The backlog in cargo ships waiting to unload in Los Angeles and Long Beach, Calif., fell for the fourth straight month in May, said Oren Klachkin of Oxford Economics. Target Corp. recently said the need to unload unwanted goods would cause its profit to drop. Clothes retailers have also been caught with swelling inventories of casual clothes and home items as shoppers scaled back spending on goods that had been popular throughout the pandemic.

-

Be careful with the strawberries. I saw on the local news a few days ago that a lot of them have been recalled because they're tainted with hepatitis c.

-

@George-K said in Inflation to be "Extraordinarily Elevated" due to Putin's price hike.:

"Today's inflation report confirms what Americans already know — Putin's price hike is hitting America hard."

That Putin guy is so crafty. He had inflation climb the year before he invaded Ukraine! Brilliant!

Actually, the rate of increase has dropped drastically since Putin invaded Ukraine…